On November 3, 20X2, PRD Corporation acquired 2 JRS Company bonds ($1,000 face value) at a cost

Question:

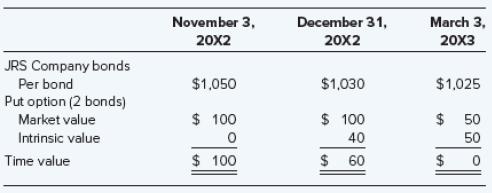

On November 3, 20X2, PRD Corporation acquired 2 JRS Company bonds ($1,000 face value) at a cost of 105. PRD classifies them as available-for-sale securities. On this same date, PRD decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $100, an at-the-money put option to sell the 2 bonds at 105. The option expires on March 3, 20X3. The fair values of the investment and the options follow:

Required

a. Prepare the entries required on November 3, 20X2, to record the purchase of the JRS bonds and the put options.

b. Prepare the entries required on December 31, 20X2, to record the change in intrinsic value and time value of the options, as well as the revaluation of the available-for-sale securities.

c. Prepare the entries required on March 3, 20X3, to record the exercise of the put option and the sale of the securities at that date.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd