One of Company Ys business units transacts in the FC. However, the functional currency of Company Y

Question:

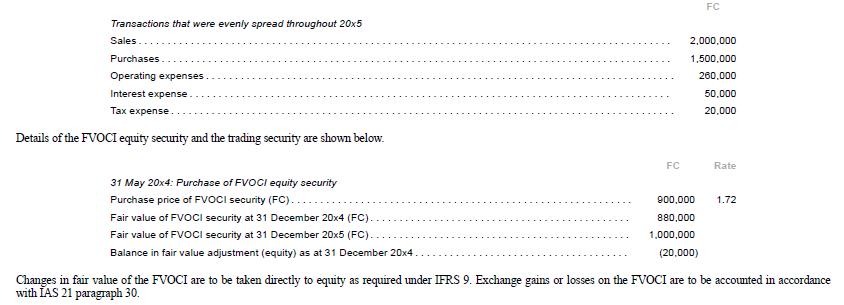

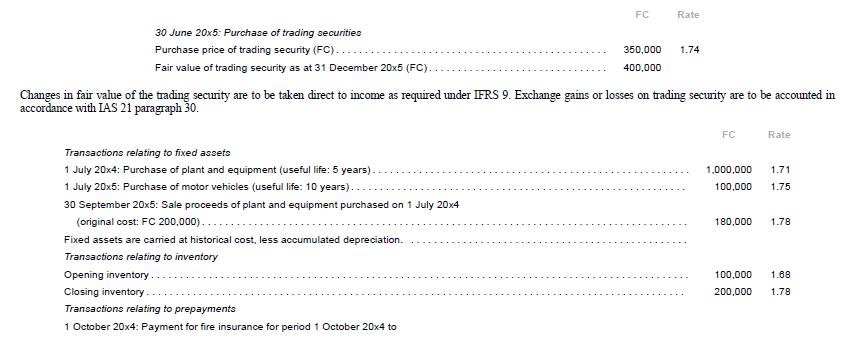

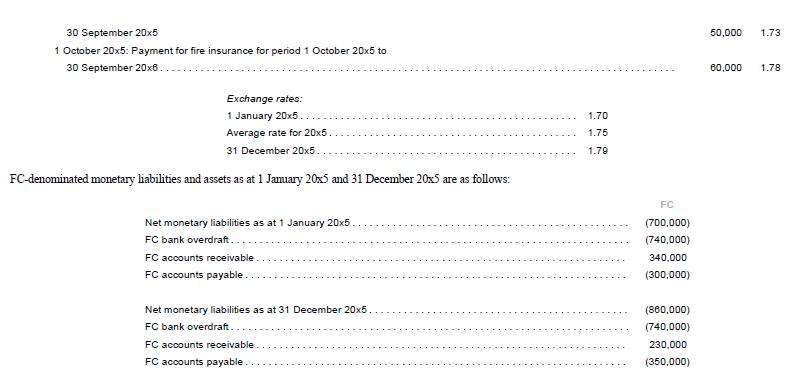

One of Company Y’s business units transacts in the FC. However, the functional currency of Company Y is the dollar. The following transactions are denominated in the FC and should be translated to the dollar in accordance with IAS 21 paragraphs 20–34. Exchange rates ($ to FC 1) at the date of the transaction are shown next to the item.

Required

1. What are the reported amounts of the following in dollars as at 31 December 20x5?

(a) Fixed assets, net book value

(b) Depreciation expense

(c) Profit/(loss) on sale of fixed assets

(d) Cost of sales

(e) FVOCI security

(f) Fair value adjustment (equity) relating to FVOCI (g) Trading securities (h) Fair value change in profit and loss relating to trading securities (i) Prepaid insurance (j) Insurance expense for the year 2. Compute the exchange gain or loss from the movements in exposed FC monetary assets/(liabilities) for the year ended 31 December 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah