Refer to P6.7 . Assume that the presentation currency of Y Co is the FC while the

Question:

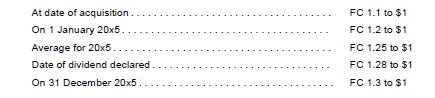

Refer to P6.7 . Assume that the presentation currency of Y Co is the FC while the functional currency is the dollar ($). P Co’s investment in Y Co is FC 1,980,000. The exchange rates are as follows:

Foreign currency translation reserve (FCTR) on 1 January 20x5 arising from the translation of net assets of Y Co (excluding the FCTR relating to goodwill and fair value adjustments) is FC 150,000 (credit balance).

Required

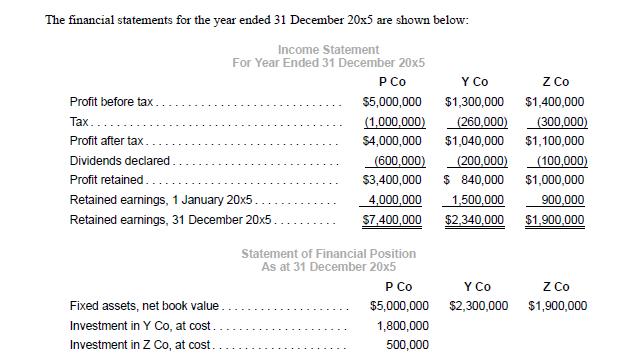

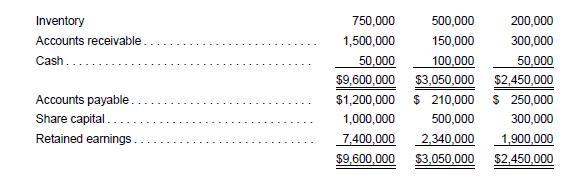

1. Translate the financial statements of subsidiary Y Co for the year ended 31 December 20x5 into the presentation currency. Perform a reconciliation check on the movement in FCTR.

2. Prepare the consolidation adjusting entries for the year ended 31 December 20x5 in FC to:

(a) Eliminate the investment in Y Co and allocate the cost of business combination;

(b) Recognize the FCTR on goodwill and intangible asset.

(c) Allocate FCTR to non-controlling interests.

Data from P6.7

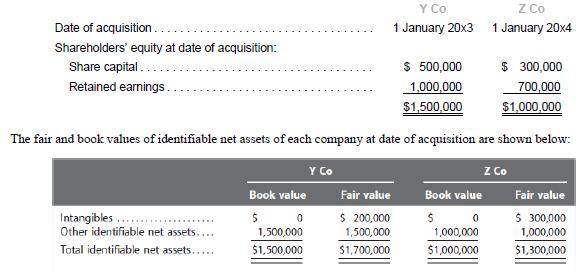

On 1 January 20x3, P Co acquired a 90% interest in Y Co. On that date, the fair value of non-controlling interests in Y Co was $180,000. A year later, on 1 January 20x4, P Co acquired a 30% interest in Z Co. Book values of equity and fair values of identifiable net assets of the acquired companies are shown below:

Additional information

(a) Unrecognized intangible asset of Z Co was impaired in 20x5 to the extent of 30% of its original fair value.

Unrecognized intangible asset of Y Co was unimpaired.

(b) On 1 January 20x5, Y Co sold equipment to P Co at an invoiced price of $150,000. At the date of the sale, the net book value of the equipment was $48,000. Its original cost was $120,000. The original useful life of the equipment was five years; it had no estimated residual value. On 1 January 20x5, the remaining useful life was estimated at three years; estimated residual value remains at nil value.

(c) P Co sold inventory to Y Co in December 20x4 at market price of $60,000. The original cost of the inventory was $70,000. The inventory was resold to third parties in 20x5.

(d) Assume a tax rate of 20%. Recognize tax on fair value adjustments.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah