P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as

Question:

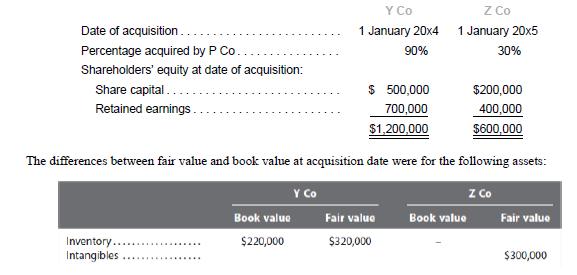

P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as follows:

Inventory of Y Co at acquisition date was sold to third parties within six months of acquisition. Intangible assets of Z Co had a remaining useful life of five years from the date of acquisition. The fair value of noncontrolling interests of Y Co at acquisition date was $140,000.

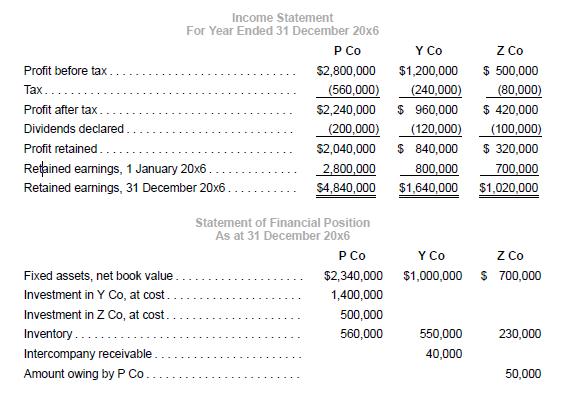

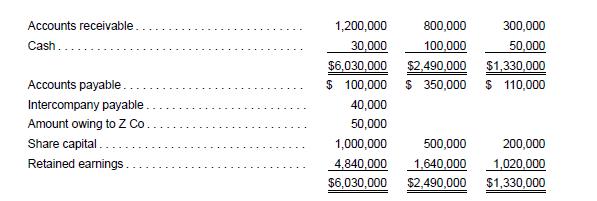

The financial statements of P Co, Y Co, and Z Co for the year ended 31 December 20x6 are shown below.

Additional information

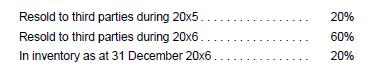

(a) On 1 November 20x5, Y Co sold inventory to P Co at a transfer price of $200,000, and recorded a gross profit of $60,000 on the sale. The subsequent resale of this batch of inventory is as follows:

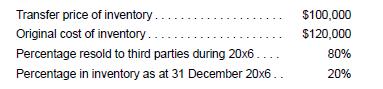

(b) In 20x6, P Co sold excess inventory to Y Co as follows:

The inventory was not impaired as at the date of transfer or subsequently.

(c) On 1 January 20x6, Z Co transferred an item of equipment to P Co at a transfer price of $172,000. The original cost of the equipment was $180,000 and the accumulated depreciation at the date of transfer was $36,000. The original useful life of the equipment was five years and the remaining useful life at the date of transfer was four years. Assume zero residual value.

(d) P Co recognized interest expense charged by Y Co and Z Co during 20x6 as follows:

![]()

The same amounts were recorded as interest income by Y Co and Z Co, respectively.

(e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments.

Required

1. Prepare consolidation and equity accounting entries for the year ended 31 December 20x6, with narratives and workings.

2. Perform an analytical check on the balance in non-controlling interests and investment in associate as at 31 December 20x6, showing workings clearly.

3. Prepare the consolidation worksheets for the year ended 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah