P Co acquired an interest in Sapphire Co and Amber Co. The financial statements for the current

Question:

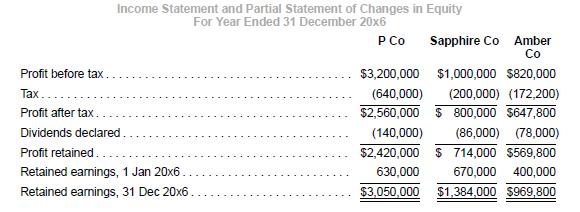

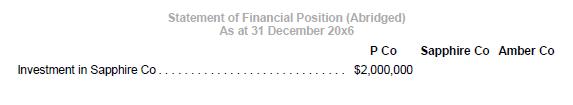

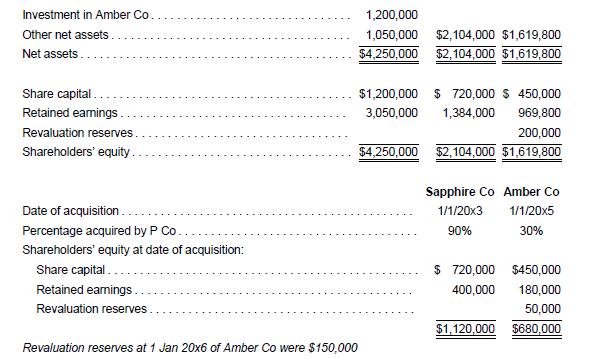

P Co acquired an interest in Sapphire Co and Amber Co. The financial statements for the current year ended 31 December 20x6 and other relevant details are shown below:

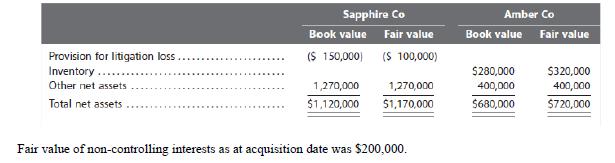

Fair and book values of identifiable net assets of each company at date of acquisition:

Additional information relating to Sapphire:

(a) The probable maximum litigation loss recognized in the separate financial statements was higher than the expected value of the loss recognized in the consolidated financial statements. Final settlement during 20x5 was $120,000.

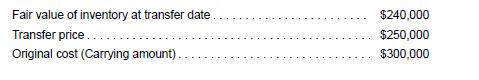

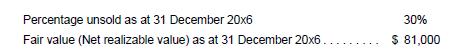

(b) On 1 July 20x6, Sapphire sold excess inventory to P Co as follows:

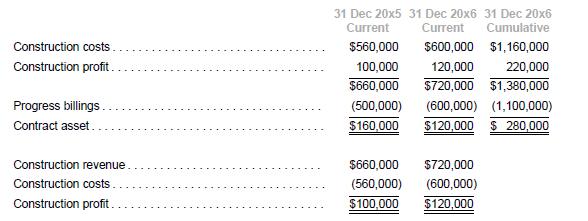

(c) Sapphire was engaged as contractor by P Co for construction of its warehouse. The construction of the warehouse was completed on 1 July 20x6. The useful life of the warehouse was 14 years with minimal residual value. The final progress billing of $280,000 was issued in June 20x7 after the end of the defects rectification period. P Co did not recognize final progress billing until June 20x7. Details are as follows:

(d) Amount due from P Co to Sapphire Co as at 31 December 20x6 was $480,000.

Additional information relating to Amber Co:

(e) The undervalued inventory of Amber Co was disposed off as follows:

(f) On 1 July 20x5, P Co transferred equipment to Amber Co at a transfer price of $380,000. The original cost of the equipment was $420,000 and the net book value was $350,000. The original useful life of the equipment was six years while its remaining useful life as at 1 July 20x5 was five years.

(g) During the year ended 31 December 20x5, Amber Co provided architectural services to P Co with respect to the construction of the warehouse. Amber earned the following income:

The building was completed on 1 July 20x6. P Co depreciated the building over the estimated useful life of 14 years. Residual value was negligible.

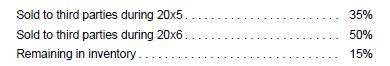

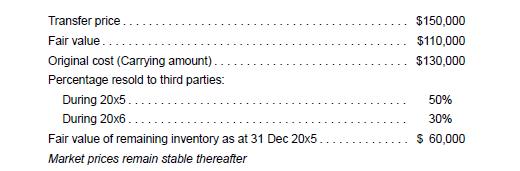

(h) During 20x5, Amber sold excess inventory to P Co as follows:

(i) As at 31 December 20x5, amount owing from P Co to Amber Co was $50,000.

(j) Tax rate for both companies is 20% throughout. Recognize tax on fair value over book value differentials.

Required

1. Prepare consolidation entries for P Co and the group for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IFRS 3 and IFRS 10.

2. Perform an analytical check on the balance in non-controlling interests in Sapphire Co as at 31 December 20x6, showing the workings clearly.

3. Prepare equity accounting entries to show P Co’s interest in Amber Co for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IAS 28.

4. Perform an analytical check on the balance in investment in Amber Co as at 31 December 20x6, showing the workings clearly.

5. Perform an analytical check on consolidated retained earnings as at 31 December 20x6, showing workings clearly.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah