Prism Co acquired 80% of the stock of Sapphire Co for $300,000 on 1 January 20x7. At

Question:

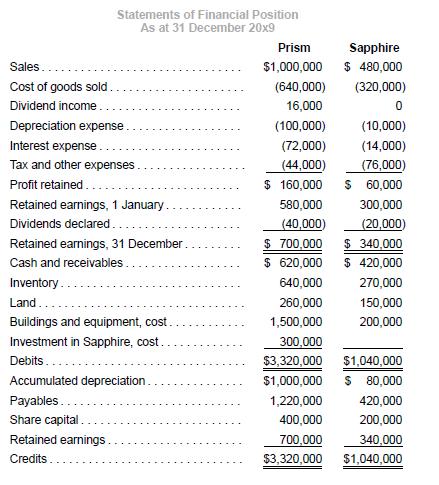

Prism Co acquired 80% of the stock of Sapphire Co for $300,000 on 1 January 20x7. At acquisition date, Sapphire reported retained earnings of $150,000. The excess of Prism Co’s acquisition cost over its share of Sapphire’s book value was assigned to buildings and equipment that had a remaining life of ten years at acquisition date and deferred tax liability on the undervalued building and equipment.

The purchase consideration paid by Prism Co was proportional to Prism’s share of the fair value of Sapphire Co as an entity. Non-controlling interests are to be measured at its share of fair value of Sapphire Co as at acquisition date. The financial statements of the two companies for the year ended 31 December 20x9 are shown below.

Investment in Sapphire Co was carried at cost.

On 1 January 20x9, Prism Co held inventory purchased from Sapphire Co during 20x8 for $15,000, which had been manufactured by Sapphire at a cost of $10,000. During 20x9, Sapphire sold goods costing $40,000 to Prism Co for $60,000. Prism sold the inventory on hand at the beginning of the year, but continued to hold 40% of its 20x9 purchases from Sapphire on 31 December 20x9. Tax rate was 20%.

Required:

1. Prepare all necessary consolidation elimination and adjustment entries for the year ended 31 December 20x9.

2. Prepare the consolidation worksheets for the year ended 31 December 20x9.

3. Perform an analytical check on the non-controlling interests’ balance as at 31 December 20x9.

4. Determine the following consolidated amounts as at 31 December 20x9 analytically and compare with the balances in your consolidation worksheets in Part 3:

(a) Inventory

(b) Buildings and equipment, net of accumulated depreciation

(c) Retained earnings

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah