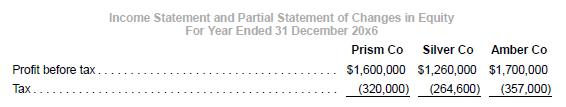

Prism Co has control over Silver Co and significant influence over Amber Co. The financial statements for

Question:

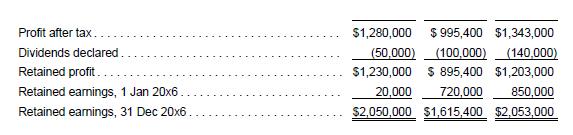

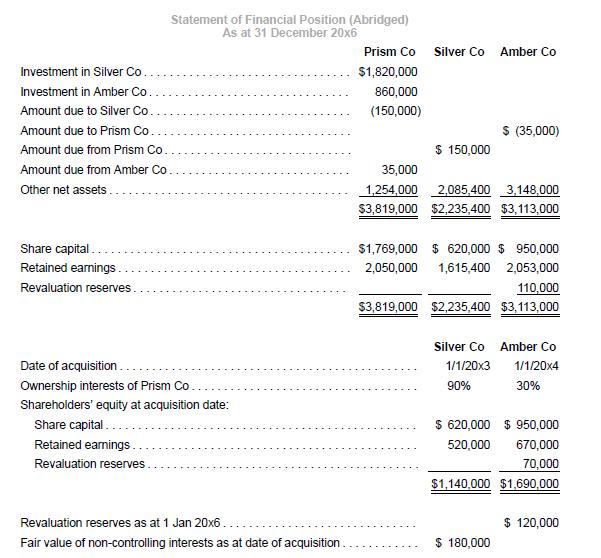

Prism Co has “control” over Silver Co and “significant influence” over Amber Co. The financial statements for 20x6 are shown below. All figures are in dollars, except otherwise indicated.

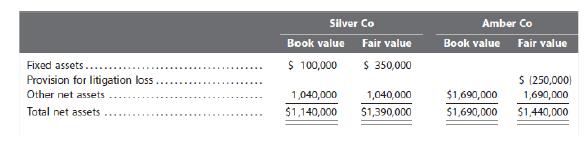

Fair and book values of identifiable net assets of each company as at date of acquisition:

Additional information:

(a) As at acquisition date, Silver Co had property and equipment that had remaining useful life of 20 years.

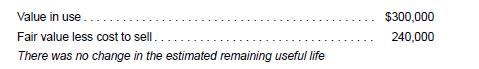

(b) During 20x4, Prism Co outsourced the development of specialized software to Silver Co. The project began on 1 March 20x4 and Silver Co had recognized revenue of $350,000 and profit of $70,000 during 20x4. The project was completed on 31 December 20x4. The expected useful life of the software was ten years from 1 January 20x5. Residual value was negligible. The project and progress billings accounts were closed on 31 December 20x4. On 31 December 20x5, new information arose with respect to the software:

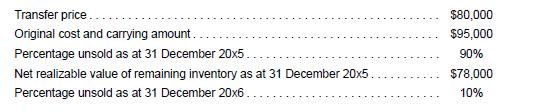

(c) During December 20x5, Prism Co sold excess inventory to Silver Co as follows:

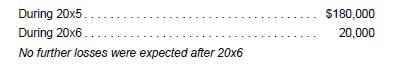

(d) Expected litigation loss as of acquisition date was settled and expensed by Amber Co as follows:

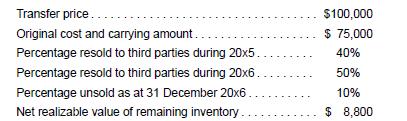

(e) During 20x5, Amber Co sold inventory to Prism Co as follows:'

(f) Prism Co recognizes non-controlling interests at full fair value at acquisition date. Apply a tax rate of 20% on all appropriate adjustments, including fair value adjustments. The legal entities recognize impairment losses, if any, at the end of each reporting period.

Required

1. Prepare consolidation adjusting entries for the year ended 31 December 20x6, with narratives (brief headers) in accordance with IFRS 3 and IFRS 10.

2. Prepare equity accounting entries for the year ended 31 December 20x6, with narratives (brief headers) in accordance with IAS 28.

3. Perform an analytical check on the balance in non-controlling interests as at 31 December 20x6.

4. Perform an analytical check on the balance of the investment in associate account as at 31 December 20x6.

5. Perform an analytical check on consolidated retained earnings as at 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah