Select the best answer for each of the following multiple-choice items. (Nos. 1, 2, 4, 6, 9,

Question:

Select the best answer for each of the following multiple-choice items. (Nos. 1, 2, 4, 6, 9, and 10 are AICPA adapted.)

1. Which of the following statements is incorrect concerning a governmental entity’s statement of cash flows?

a. Cash flows from capital financing activities and cash flows from noncapital financing activities are reported separately.

b. The statement format is the same as that of a business enterprise’s statement of cash flows.

c. Cash flows from operating activities may not be reported using the indirect method.

d. The cash flows statement is not prepared by the general fund.

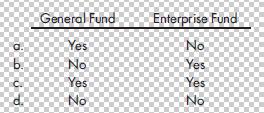

2. Which of the following funds of a governmental unit recognizes revenues in the accounting period only when they are both available and measurable?

3. If an internal service fund is intended to operate on a cost-reimbursement basis, then user charges should

a. cover the full costs, both direct and indirect, of operating the fund.

b. cover the full costs of operating the fund and provide for future expansion and replacement of capital assets.

c. cover at a minimum the direct costs of operating the fund.

d. do all of the above.

4. The billings for transportation services provided to other governmental units are recorded by the internal service fund as

a. other financing sources.

b. intergovernmental transfers.

c. transportation appropriations.

d. operating revenues.

5. Bonds are issued at a premium by a capital projects fund. The premium should be

a. retained in the capital projects fund.

b. credited directly to the restricted fund balance of the capital projects fund.

c. transferred to the debt service funds.

d. used to reduce the net cost of the project involved.

6. Revenues that are legally restricted to expenditures for specified purposes should be accounted for in special revenue funds, including

a. accumulation of resources for payment of general long-term debt principal and interest.

b. pension trust fund revenues.

c. gasoline taxes to finance road repairs.

d. proprietary fund revenues.

7. The police department of the city of Elizabeth acquires a new police car during the current year. In reporting the balance sheet for the governmental funds within the fund-based financial statements, what reporting is made of this police car?

a. It is reported as a police car at its cost.

b. It is reported as a police car at cost less accumulated depreciation.

c. It is reported as equipment at fair value.

d. It is not reported.

8. Resources for a capital improvement are provided by special assessments. At the start of the second year of the project, a reclassification entry in the debt service fund that debits Deferred Inflows of Resources would credit

a. Special Assessments Receivable—Non-Current

b. Fund Balance Restricted for Special Assessments.

c. Unassigned Fund Balance.

d. Revenues.

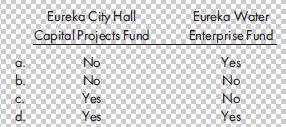

9. Eureka City should issue a statement of cash flows for which of the following funds?

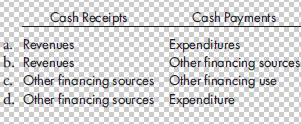

10. Delaware City’s serial bonds are serviced through a debt service fund with cash provided by the general fund. In a debt service fund’s statements, how are cash receipts and cash payments reported?

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng