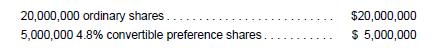

The capital structure of Model Company on 31 December 20x2 is as follows: The preference shares were

Question:

The capital structure of Model Company on 31 December 20x2 is as follows:

The preference shares were convertible into ordinary shares in the ratio of 1,000 preference shares for 500 ordinary shares. The conversion ratio was to be adjusted for any bonus or rights issue. Preference dividends, which were tax exempt, were payable every six months on the shares outstanding at 30 June and 31 December. No preference dividends were paid if preference shares were converted after these two dates.

Additional information

(a) Model Company had an outstanding agreement made in 20x2 with its chief executive officer that entitled the chief executive officer to a bonus of 100,000 ordinary shares if the company’s net profit after tax exceeded $3,000,000 in any of the years in the next three years. The bonus shares were adjustable for any bonus issue made after the date of the agreement.

(b) On 1 April 20x3, Model Company declared and issued bonus shares based on one bonus share for every existing four ordinary shares.

(c) On 1 July 20x3, Model Company issued $10,000,000 2% convertible bonds. The bonds were convertible into ordinary shares in the ratio of $1,000 nominal value of bonds for 550 ordinary shares. Interest on the bonds was payable semi-annually on 30 June and 31 December. The bonds matured on 30 June 20x5. A similar bond without the conversion feature would have carried a coupon rate of 4% if issued at the same date.

(d) On 1 January 20x4, Model Company implemented an executive compensation plan that granted 2,000,000 options to certain key executives. Each share option entitled the holder to subscribe for one new ordinary share at the price of $1.50 per share. None of the options had been exercised.

(e) On 1 April 20x4, Model Company made a rights issue of three new ordinary shares for every five existing ordinary shares at a subscription price of $1.20. The market price of Model Company’s share before it went exrights was $2.

(f) On 1 July 20x4, 40% of the convertible bonds were converted into ordinary shares.

(g) On 1 September 20x4, the company induced holders of the convertible preference shares to convert their preference shares into ordinary shares by changing the conversion ratio to 750 ordinary shares for every 1,000 preference shares. All the preference shareholders accepted the improved conversion terms and converted their preference shares. The fair value of the ordinary shares at the time of conversion was $2.50.

(h) The average market prices of Model Company’s share were $2.20 and $2.50 during 20x3 and 20x4, respectively.

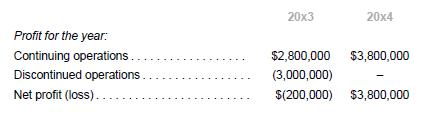

(i) The net profit after tax of Model Company for the years ended 31 December 20x3 and 20x4 is as follows:

(j) The income tax rate was 20%.

Required

1. Calculate the basic and diluted earnings per share for the year ended 31 December 20x3.

2. Calculate the basic and diluted earnings per share for the year ended 31 December 20x4. Show the comparative earnings per share for 20x3 that should be reported in the 20x4’s financial statements.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah