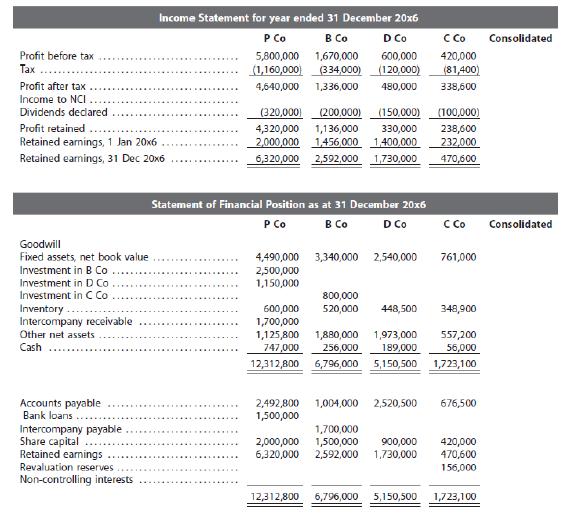

The financial statements of P Co and its subsidiaries and associate are as follows: Additional information 1.

Question:

The financial statements of P Co and its subsidiaries and associate are as follows:

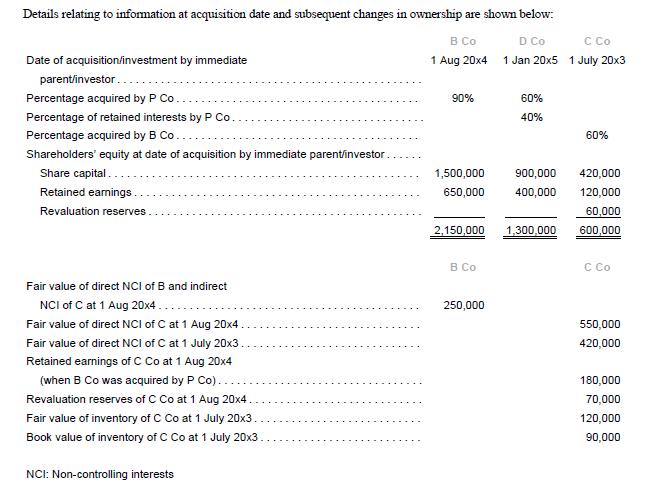

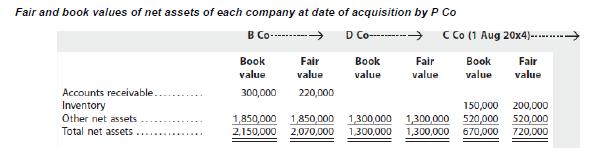

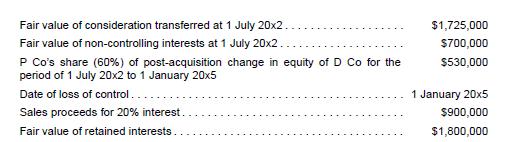

Additional information

1. D Co was originally a subsidiary of P Co when P Co purchased an initial investment of 60% interest in D Co. On 1 January 20x5, P Co sold 20% interest in D Co, reducing the ownership interest in D Co to 40%.

![]()

2. The fair value of accounts receivable of B Co was lower than the book value because of an expected loss on a debtor. B Co recognized an incurred loss in 20x6 when the debtor went into bankruptcy. In 20x6, B Co expensed off $280,000 as impairment losses.

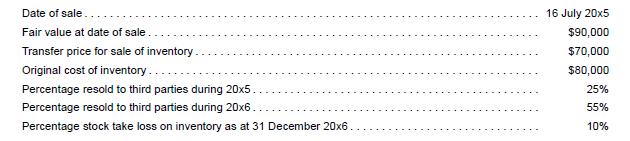

3. The undervalued inventory of C Co was disposed as follows:

![]()

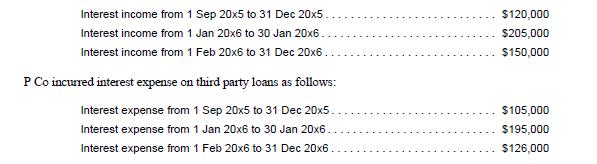

4. P Co provided a long term loan to B Co on 1 September 20x5 to finance the construction of equipment. The use of the loan proceeds met the requirements of IAS 23 Borrowing Costs. B Co completed the construction of the equipment on 1 February 20x6 and commenced the depreciation of the equipment over a useful life of 5 years from that date. Residual value is negligible. The following interest income was recognized by P Co:

5. There was a sale of inventory from D Co to P Co, with details as follows:

6. Apply a tax rate of 20% on all appropriate adjustments. Recognize tax effects on fair value adjustments. Companies recognize impairment losses, if any, at the financial year-end.

Requirement

Prepare the consolidation and equity accounting entries for the year ended 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah