China Petroleum and Chemical Corporation China Petroleum and Chemical Corporation (CPCC) is one of a growing number

Question:

China Petroleum and Chemical Corporation China Petroleum and Chemical Corporation (CPCC) is one of a growing number of Chinese companies that has cross-listed its stock on foreign stock exchanges. To provide information that might be useful for a wide audience of readers outside of China, CPCC provides a reconciliation of income and stockholders’ equity from Chinese GAAP to IFRS. Further, to provide information specifically for its North American shareholders, the company also provides a reconciliation of net income and stockholders’ equity from IFRS to U.S. GAAP. The following is the section of CPCC’s 2003 annual report providing this information.

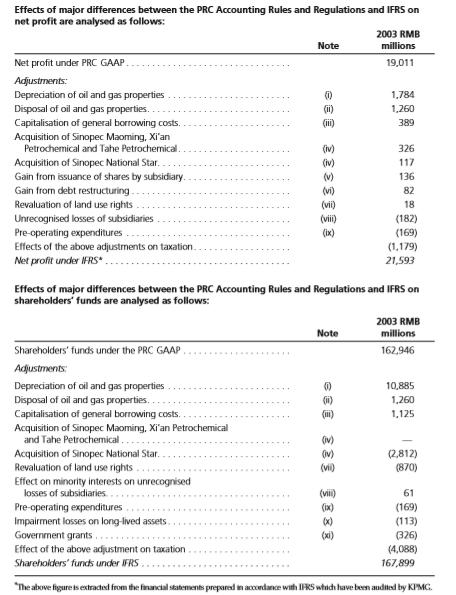

Differences between Financial Statements Prepared under the Chinese GAAP and IFRSs

The major differences are:

i. Depreciation of oil and gas properties

Under the PRC accounting rules and regulations, oil and gas properties are depreciated on a straight-line basis. Under IFRS, oil and gas properties are depreciated on the unit of production method.

ii. Disposal of oil and gas properties

Under the PRC accounting rules and regulations, gains and losses arising from the retirement or disposal of an individual item of oil and gas properties are recognized as income or expense in the income statement and are measured as the difference between the estimated net disposal proceeds and the carrying amount of the asset.

Under IFRS, gains and losses on the retirement or disposal of an individual item of proved oil and gas properties are not recognized unless the retirement or disposal encompasses an entire property. The costs of the asset abandoned or retired are charged to accumulated depreciation with the proceeds received on disposals credited to the carrying amounts of oil and gas properties.

iii. Capitalisation of general borrowing costs

Under the PRC accounting rules and regulations, only borrowing costs on funds that are specially borrowed for construction are capitalized as part of the cost of fixed assets. Under IFRS, to the extent that funds are borrowed generally and used for the purpose of obtaining a qualifying asset, the borrowing costs should be capitalized as part of the cost of that asset.

iv. Acquisition of Sinopec National Star, Sinopec Maoming, Xi’an Petrochemical and Tahe Petrochemical

Under the PRC accounting rules and regulations, the acquisition of Sinopec National Star, Sinopec Maoming, Xi’an Petrochemical and Tahe Petrochemical (the “Acquisitions”) are accounted for by the acquisition method. Under the acquisition method, the income of an acquiring enterprise includes the operations of the acquired enterprise subsequent to the acquisition. The difference between the cost of acquiring Sinopec National Star and the fair value of the net assets acquired is capitalized as an exploration and production right, which is amortised over 27 years.

Under IFRS, as the Group, Sinopec National Star, Sinopec Maoming, Xi’an Petrochemical and Tahe Petrochemical are under the common control of Sinopec Group Company, the Acquisitions are considered “combination of entities under common control” which are accounted in a manner similar to a pooling-of-interests (“as in pooling of interests accounting”). Accordingly, the assets and liabilities of Sinopec National Star, Sinopec Maoming, Xi’an Petrochemicals and Tahe Petrochemicals acquired have been accounted for at historical cost and the financial statements of the Group for periods prior to the Acquisitions have been restated to include the financial statements and results of operations of Sinopec National Star, Sinopec Maoming, Xi’an Petrochemicals and Tahe Petrochemical on a combined basis. The consideration paid by the Group are treated as an equity transaction.

v. Gains from issuance of shares by a subsidiary

Under the PRC accounting rules and regulations, the increase in the company’s share of net assets of a subsidiary after the sale of additional shares by the subsidiary is credited to capital reserve. Under IFRS, such increase is recognised as income.

vi. Gain from debt restructuring

Under the PRC accounting rules and regulations, gain from debt restructuring resulting from the difference between the carrying amount of liabilities extinguished or assumed by other parties and the amount paid is credited to capital reserve. Under IFRS, the gain resulting from such difference is recognised as income.

vii. Revaluation of land use rights

Under the PRC accounting rules and regulations, land use rights are carried at revalued amounts. Under IFRS, land use rights are carried at historical cost less amortisation. Accordingly, the surplus on the revaluation of land use rights, credited to revaluation reserve, was eliminated.

viii. Unrecognised losses of subsidiaries

Under the PRC accounting rules and regulations, the results of subsidiaries are included in the Group’s consolidated income statement to the extent that the subsidiaries’ accumulated losses do not result in their carrying amount being reduced to zero, without the effect of minority interests. Further, losses are debited to a separate reserve in the shareholders’ funds.

Under IFRS, the results of subsidiaries are included in the Group’s consolidated income statement from the date that control effectively commences until the date that control effectively ceases.

ix. Pre-operating expenditures

Under the PRC accounting rules and regulations, expenditures incurred during the start-up period are aggregated in long-term deferred expenses and charged to the income statement when operations commence. Under IFRS, expenditures on start-up activities are recognized as an expense when they are incurred.

x. Impairment losses on long-lived assets

Under the PRC accounting rules and regulations and IFRS, impairment charges are recognized when the carrying value of long-lived assets exceeds the higher of their net selling price and the value in use which incorporates discounting the asset’s estimated future cash flows. Due to the difference in the depreciation method of oil and gas properties discussed in (i) above, the provision for

impairment losses and reversal of impairment loss under the PRC Accounting Rules and Regulations are different from the amounts recorded under IFRS.

xi. Government grants

Under the PRC accounting rules and regulations, government grants should be credited to capital reserve. Under IFRS, government grants relating to the purchase of equipment used for technology improvements are initially recorded as long term liabilities and are offset against the cost of assets to which the grants related when construction commences. Upon transfer to property, plant and equipment, the grants are recognized as an income over the useful life of the property, plant and equipment by way of reduced depreciation charge.

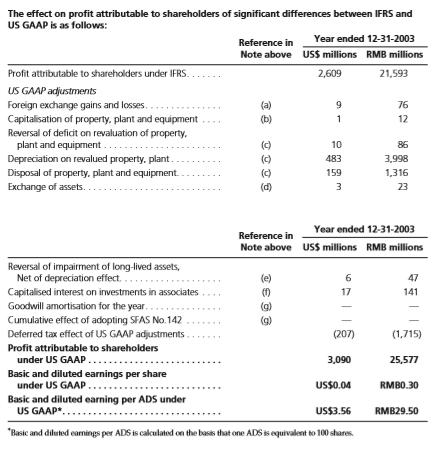

Supplemental Information for North American Shareholders

The Group’s accounting policies conform with IFRS which differ in certain significant respects from accounting principles generally accepted in the United States of America (“US GAAP”). Information relating to the nature and effect of such differences are set out below. The US GAAP reconciliation presented below is included as supplemental information, is not required as part of the basic financial statements and does not include differences related to classification, display or disclosures.

a. Foreign exchange gains and losses

In accordance with IFRS, foreign exchange differences on funds borrowed for construction are capitalized as property, plant and equipment to the extent that they are regarded as an adjustment to interest costs during the construction period. Under US GAAP, all foreign exchange gains and losses on foreign currency debts are included in current earnings.

b. Capitalisation of property, plant and equipment

In the years prior to those presented herein, certain adjustments arose between IFRS and US GAAP with regard to the capitalization of interest and pre-production results under IFRS that were reversed and expensed under US GAAP. For the years presented herein, there were no adjustments related to the capitalization of interest and pre-production results. Accordingly, the US GAAP adjustments represent the amortisation effect of such originating adjustments described above.

c. Revaluation of property, plant and equipment

As required by the relevant PRC regulations with respect to the Reorganisation, the property, plant and equipment of the Group were revalued at 30 September 1999. In addition, the property, plant and equipment of Sinopec National Star, Sinopec Maoming and Refining Assets were revalued at 31 December 2000, 30 June 2003 and 31 October 2003 respectively in connection with the Acquisitions. Under IFRS, such revaluations result in an increase in shareholders’ funds with respect to the increase in carrying amount of certain property, plant and equipment below their cost bases.

Under US GAAP, property, plant and equipment, including land use rights, are stated at their historical cost less accumulated depreciation. However, as a result of the tax deductibility of the net revaluation surplus, a deferred tax asset related to the reversal of the revaluation surplus is created under US GAAP with a corresponding increase in shareholders’ funds.

Under IFRS, effective 1 January 2002, land use rights, which were previously carried at revalued amount, are carried at cost under IFRS. The effect of this change resulted in a decrease to revaluation reserve net of minority interests of RMB 840 million as of 1 January 2002. This revaluation reserve was previously included as part of the revaluation reserve of property, plant and equipment. This change under IFRS eliminated the US GAAP difference relating to the revaluation of land use rights. However, as a result of the tax deductibility of the revalued land use rights, the reversal of the revaluation reserve resulted in a deferred tax asset.

In addition, under IFRS, on disposal of a revalued asset, the related revaluation surplus is transferred from the revaluation reserve to retained earnings. Under US GAAP, the gain and loss on disposal of an asset is determined with reference to the asset’s historical carrying amount and included in current earnings.

d. Exchange of assets

During 2002, the Company and Sinopec Group Company entered into an asset swap transaction. Under IFRS, the cost of property, plant and equipment acquired in an exchange for a similar item of property, plant and equipment is measured at fair value. Under US GAAP, as the exchange of assets was between entities under common control, the assets received from Sinopec Group Company are measured at historical cost. The difference between the historical cost of the net assets transferred and the net assets received is accounted for as an equity transaction.

e. Impairment of long-lived assets

Under IFRS, impairment charges are recognized when a long-lived asset’s carrying amount exceeds the higher of an asset’s net selling price and value in use, which incorporates discounting the asset’s estimated future cash flows. Under US GAAP, determination of the recoverability of a long-lived asset is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its eventual disposition. If the sum of the expected future cash flows is less than the carrying amount of the asset, an impairment loss is recognized. Measurement of an impairment loss for a long-lived asset is based on the fair value of the asset. In addition, under IFRS, a subsequent increase in the recoverable amount of an asset is reversed to the consolidated income statement to the extent that an impairment loss on the same asset was previously recognized as an expense when the circumstances and events that led to the write-down

or write-off cease to exist. The reversal is reduced by the amount that would have been recognized as depreciation had the write-off not occurred. Under US GAAP, an impairment loss establishes a new cost basis for the impaired asset and the new cost basis should not be adjusted subsequently other than for further impairment losses.

The US GAAP adjustment represents the effect of reversing the recovery of previous impairment charge recorded under IFRS.

f. Capitalised interest on investment in associates

Under IFRS, investment accounted for by the equity method is not considered a qualifying asset for which interest is capitalized. Under US GAAP, an investment accounted for by the equity method while the investee has activities in progress necessary to commence its planned principal operations, provided that the investee’s activities include the use of funds to acquire qualifying assets for its operations, is a qualifying asset for which interest is capitalized.

g. Goodwill amortisation

Under IFRS, goodwill and negative goodwill are amortised on a systematic basis over their useful lives.

Under US GAAP, with reference to Statement of Financial Accounting Standard No.142, “Goodwill and Other Intangible Assets” (“SFAS No. 142”), goodwill is no longer amortised beginning 1 January 2002, the date that SFAS No. 142 was adopted. Instead, goodwill is reviewed for impairment upon adoption of SFAS No. 142 and annually thereafter. In connection with SFAS No. 142’s transitional goodwill impairment evaluation, the Group determined that no goodwill impairment existed as of the date of adoption. In addition, under US GAAP, negative goodwill of RMB 11 million, net of minority interests that existed at the date of adoption of SFAS No. 142 was written off as a cumulative effect of a change in accounting principle.

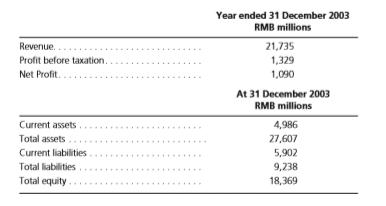

h. Companies included in consolidation

Under IFRS, the Group consolidates less than majority owned entities in which the Group has the power, directly or indirectly, to govern the financial and operating policies of an entity so as to obtain benefits from its activities, and proportionately consolidates jointly controlled entities in which the Group has joint control with other venturers. However, US GAAP requires that any entity of which the Group owns 20% to 50% of total outstanding voting stock not be consolidated nor proportionately consolidated, but rather be accounted for under the equity method. Accordingly, certain of the Group’s subsidiaries of which the Group owns between 40.72% to 50% of the outstanding voting stock, and the Group’s jointly controlled entities are not consolidated nor proportionately consolidated under US GAAP and instead accounted for under the equity method. This exclusion does not affect the profit attributable to shareholders or shareholders’ funds reconciliation between IFRS and US GAAP.

Presented below is summarized financial information of such subsidiaries and jointly controlled entities.

i. Related party transactions

Under IFRS, transactions of state-controlled enterprises with other state-controlled enterprises are not required to be disclosed as related party transactions. Furthermore, government departments and agencies are deemed not to be related parties to the extent that such dealings are in the normal course of business. Therefore, related party transactions as disclosed in Note 33 in the financial statements prepared under IFRS only refers to transactions with enterprises over which Sinopec Group Company is able to exercise significant influence. Under US GAAP, there are no similar exemptions. Although the majority of the Group’s activities are with PRC government authorities and affiliates and other PRC state-owned enterprises, the Group believes that it has provided meaningful disclosures of related party transactions in Note 33 to the financial statements prepared under IFRS.

Required

1. Critically comment on the results reported by CPCC under PRC GAAP, IFRS, and U.S. GAAP.

2. Identify the main areas of difference for CPCC between:

a. PRC GAAP and IFRS.

b. IFRS and U.S. GAAP.

3. Should UK readers of these financial statements find the information useful?

4. Should U.S. readers of these financial statements find the information useful?

5. Would you recommend that other companies adopt the multiple standards approach taken by CPCC? Explain.

Step by Step Answer: