The functional currency of K Co is the US dollar. On 1 January 2010, the management of

Question:

The functional currency of K Co is the US dollar. On 1 January 2010, the management of K Co approved a decision to buy equipment for S$1,400,000. The equipment does not meet the conditions of a qualifying asset as defined by IAS 23 Borrowing Costs. After carrying an intensive search for suppliers, on 30 June 2010, K Co places a noncancellable order to purchase the equipment. The equipment is delivered on 31 December 2010 and the payable is settled on 30 June 2011. The equipment is depreciated over a useful life of ten years with zero residual value.

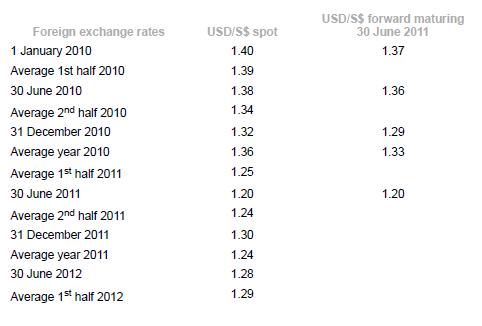

K Co entered into a foreign exchange (FX) forward transaction on 1 January 2010 with an external broker B Co to buy S$1,400,000 and sell US dollar to hedge the foreign exchange risk in the purchase of equipment. The US$/S$ forward rate is 1.37 (that is, 1 US$ S$1.37) and maturity date is 30 June 2011.

Required

Prepare the journal entries in K Co’s book in 2010 and 2011 for the equipment and foreign exchange (FX) forward in accordance with IFRS 9 Financial Instruments and IAS 21 The Effects of Changes in Foreign Exchange Rates.

Ignore taxes. (Convert the US$/S$ rates to S$/USD$ rates). State the effective FX rates at which the equipment cost and cash settlement are locked in.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah