Question: Use the data presented in Problem 1-27 to do the following: a. Record the combination on Boogie Musical Corporation's books assuming that the combination was

Use the data presented in Problem 1-27 to do the following:

a. Record the combination on Boogie Musical Corporation's books assuming that the combination was treated as a pooling of interests and Boogie issued 9,000 of its \(\$ 10\) par common shares in exchange for Toot-Toot Tuba Company's assets and liabilities.

b. Present the capital section of Boogie's balance sheet immediately after the combination, assuming that the combination was treated as a pooling of interests and Boogie issued 26,000 shares of its common stock in exchange for all the assets and liabilities of Toot-Toot.

c. Record the combination on Boogie's books assuming that the combination was treated as a pooling of interests and Boogie issued 9,000 of its \(\$ 10\) par common shares to acquire all TootToot's common stock. Both companies retain their separate identities subsequent to the combination.

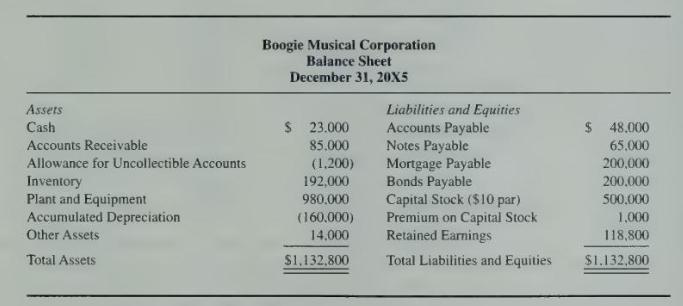

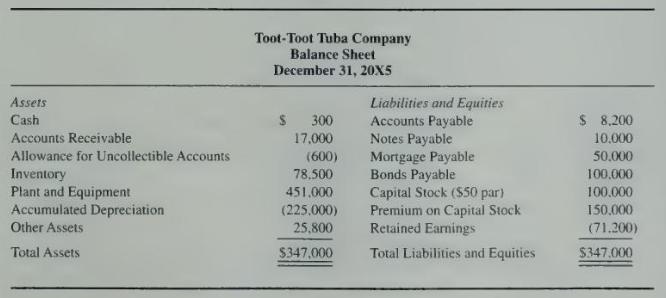

Data From Problem 1-27 Below are the balance sheets of the Boogie Musical Corporation and the Toot-Toot Tuba Company as of December 31, \(20 \mathrm{X} 5\).

In preparation for a possible business combination, a team of experts from Boogie Musical made a thorough examination and audit of Toot-Toot Tuba. They found that Toot-Toot's assets and liabilities were correctly stated except that they estimated uncollectible accounts at \(\$ 1,400\). They also estimated the market value of the inventory at \(\$ 35,000\) and the market value of the plant and equipment at \(\$ 500,000\). The business combination took place on January 1, 20X6, and on that date Boogie Musical acquired all the assets and liabilities of Toot-Toot Tuba. On that date, Boogie's common stock was selling for \(\$ 55\) per share.

Assets Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Plant and Equipment Accumulated Depreciation Other Assets Total Assets Boogie Musical Corporation Balance Sheet December 31, 20X5 Liabilities and Equities $ 23.000 Accounts Payable $ 48.000 85.000 Notes Payable 65.000 (1.200) Mortgage Payable 200,000 192,000 Bonds Payable 200,000 980,000 Capital Stock ($10 par) 500,000 (160.000) Premium on Capital Stock 1,000 14,000 Retained Earnings 118,800 $1,132,800 Total Liabilities and Equities $1.132,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts