Question: Using the data presented in Problem 1-26, (a) prepare all journal entries to record the acquisition on Ramrod Manufacturing's books, and ((b)) prepare a balance

Using the data presented in Problem 1-26,

(a) prepare all journal entries to record the acquisition on Ramrod Manufacturing's books, and \((b)\) prepare a balance sheet immediately following the business combination when pooling of interests accounting is used in recording the acquisition.

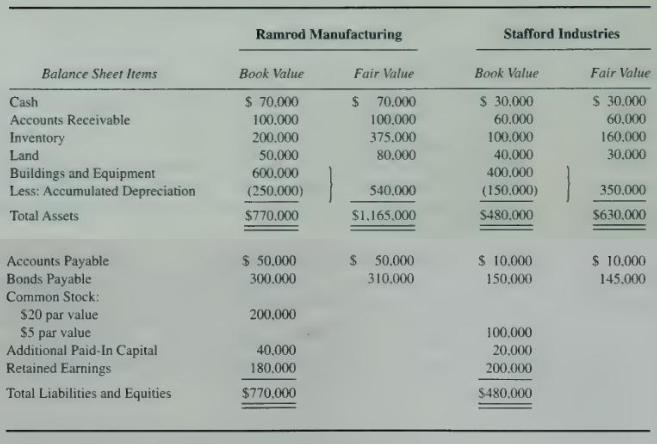

Data From Problem 1-26 Ramrod Manufacturing acquired all the assets and liabilities of Stafford Industries on January 1, \(20 \mathrm{X} 2\), in exchange for 4.000 shares of its \(\$ 20\) par value common stock. Balance sheet data for both companies just before the merger are given as follows:

Ramrod shares were selling for \(\$ 150\) on the date of acquisition.

\section*{Required}

Assuming purchase accounting is appropriate for the business combination, prepare the following:

a. Journal entries to record the acquisition on Ramrod's books.

b. A balance sheet for the combined enterprise immediately following the business combination.

Ramrod Manufacturing Stafford Industries Balance Sheet Items Book Value Fair Value Book Value Fair Value Cash $ 70,000 Accounts Receivable 100.000 Inventory 200.000 $ 70.000 100.000 375.000 $ 30,000 60.000 100.000 $ 30.000 60,000 160.000 Land 50.000 80.000 40.000 30.000 Buildings and Equipment 600.000 400.000 Less: Accumulated Depreciation (250.000) Total Assets $770.000 540,000 $1,165.000 (150.000) 350,000 $480.000 $630,000 Accounts Payable $ 50.000 Bonds Payable Common Stock: $20 par value $5 par value Additional Paid-In Capital Retained Earnings 300.000 $ 50.000 310.000 $ 10,000 $ 10.000 150,000 145.000 200,000 40,000 100,000 20.000 180.000 200.000 Total Liabilities and Equities $770,000 $480.000

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts