Question: Using the data presented in E113, determine the amount Planter Corporation would record as a gain on bargain purchase and prepare the journal entry Planter

Using the data presented in E1–13, determine the amount Planter Corporation would record as a gain on bargain purchase and prepare the journal entry Planter would record at the time of the exchange if Planter issued bonds with a par value of $580,000 and a fair value of $564,000 in completing the acquisition of Sorden.

Data from Exercises 13

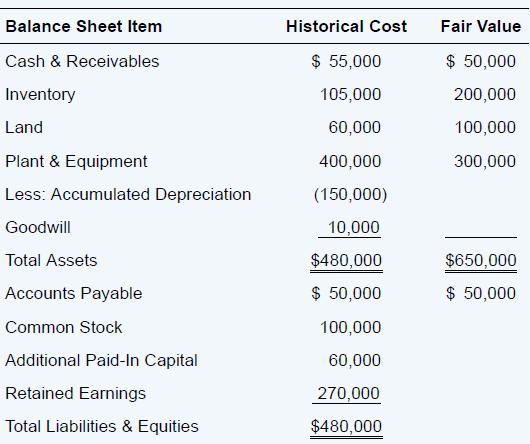

Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Planter was $608,000. The following balance sheet data were reported by Sorden:

Balance Sheet Item Cash & Receivables Inventory Land Plant & Equipment Less: Accumulated Depreciation Goodwill Total Assets Accounts Payable Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities & Equities Historical Cost $ 55,000 105,000 60,000 400,000 (150,000) 10,000 $480,000 $ 50,000 100,000 60,000 270,000 $480,000 Fair Value $ 50,000 200,000 100,000 300,000 $650,000 $ 50,000

Step by Step Solution

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Journal entry to record acquisition of Sorden Company net ass... View full answer

Get step-by-step solutions from verified subject matter experts