Question: Using the data presented in E5-5, prepare a solution assuming the business combination occurred prior to the effective date of FASB 141R. E5-5, Power Company

Using the data presented in E5-5, prepare a solution assuming the business combination occurred prior to the effective date of FASB 141R.

E5-5,

Power Company owns 90 percent of Pleasantdale Dairy's stock. The balance sheets of the two companies immediately after the Pleasantdale acquisition showed the following amounts:

The fair value of the noncontrolling interest at the date of acquisition was determined to be $30,000. The full amount of the increase over book value is assigned to land held by Pleasantdale. At the date of acquisition, Pleasantdale owed Power $8,000 plus $900 accrued interest. Pleasantdale had recorded the accrued interest, but Power had not.

Required

Prepare and complete a consolidated balance sheet workpaper.

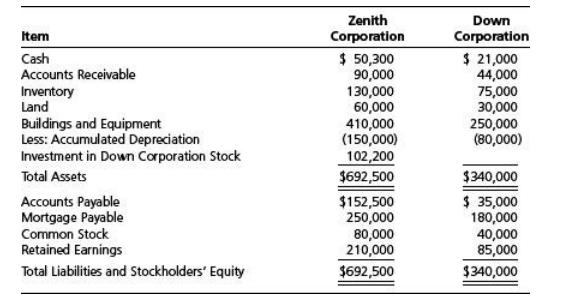

Item Cash Accounts Receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Investment in Down Corporation Stock Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Zenith Corporation $ 50,300 90,000 130,000 60,000 410,000 (150,000) 102,200 $692,500 $152,500 250,000 80,000 210,000 $692,500 Down Corporation $ 21,000 44,000 75,000 30,000 250,000 (80,000) $340,000 $ 35,000 180,000 40,000 85,000 $340,000

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

ANSWER To determine the consolidated balance sheet immediately after the acquisition we need to reco... View full answer

Get step-by-step solutions from verified subject matter experts