Question: Using the data presented in P5-33, prepare a solution as if the business combination occurred prior to the effective date of FASB 141R. P5-33, Power

Using the data presented in P5-33, prepare a solution as if the business combination occurred prior to the effective date of FASB 141R.

P5-33,

Power Corporation acquired 75 percent of Best Company's ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of Best's net assets at acquisition was $100,000. The book values and fair values of Best's assets and liabilities were equal, except for Best's buildings and equipment, which were worth $20,000 more than book value. Buildings and equipment are depreciated on a 10-year basis.

Although goodwill is not amortized, the management of Power concluded at December 31, 20X8, that goodwill from its purchase of Best shares had been impaired and the correct carrying amount was $2,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. (Note that Power Company does not adjust its Income from Subsidiary for goodwill impairment under the basic equity method.) No additional impairment occurred in 20X9.

Required

a. Give all eliminating entries needed to prepare a three-part consolidation workpaper as of December 31, 20X9.

b. Prepare a three-part consolidation workpaper for 20X9 in good form.

c. Prepare a consolidated balance sheet, income statement, and retained earnings statement for 20X9.

Goodwill at acquisition will be reported as the excess of the amount paid by the parent in acquiring ownership over its share of the fair value of the net assets of the subsidiary. Ignore the instruction in the problem that indicates goodwill impairment is assigned proportionately to the controlling and noncontrolling shareholders.

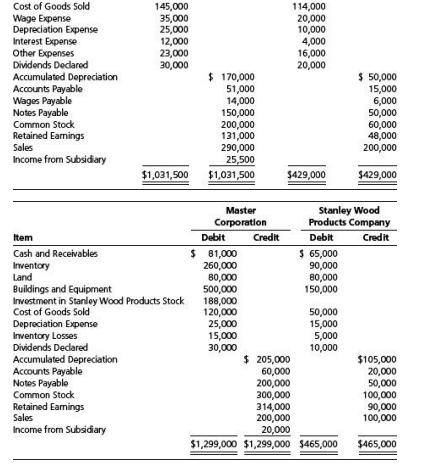

Cost of Goods Sold Wage Expense Depreciation Expense Interest Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Wages Payable Notes Payable Common Stock Retained Earnings Sales Income from Subsidiary 145,000 35,000 25,000 12,000 Sales Income from Subsidiary 23,000 30,000 $ 170,000 51,000 14,000 150,000 200,000 131,000 290,000 25,500 $1,031,500 $1,031,500 Item Cash and Receivables Inventory Land Buildings and Equipment Investment in Stanley Wood Products Stock Cost of Goods Sold Depreciation Expense Inventory Losses Dividends Declared Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Master Corporation Debit $ 81,000 260,000 80,000 500,000 188,000 120,000 25,000 15,000 30,000 Credit $429,000 $ 205,000 60,000 114,000 20,000 10,000 4,000 16,000 20,000 200,000 300,000 50,000 15,000 5,000 10,000 $ 50,000 15,000 6,000 50,000 60,000 48,000 200,000 Stanley Wood Products Company Debit Credit $ 65,000 90,000 80,000 150,000 314,000 200,000 20,000 $1,299,000 $1,299,000 $465,000 $429,000 $105,000 20,000 50,000 100,000 90,000 100,000 $465,000

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Solution to P533 assuming the business combination occurred prior to the effective date of FASB 141R a Eliminating entries needed to prepare a threepa... View full answer

Get step-by-step solutions from verified subject matter experts