Question: Using the data presented in P1020: Required a. Prepare a worksheet to develop a consolidated statement of cash flows for 20X4 using the direct method

Using the data presented in P10–20:

Required

a. Prepare a worksheet to develop a consolidated statement of cash flows for 20X4 using the direct method of computing cash flows from operations.

b. Prepare a consolidated statement of cash flows for 20X4.

Data from Exercises 20

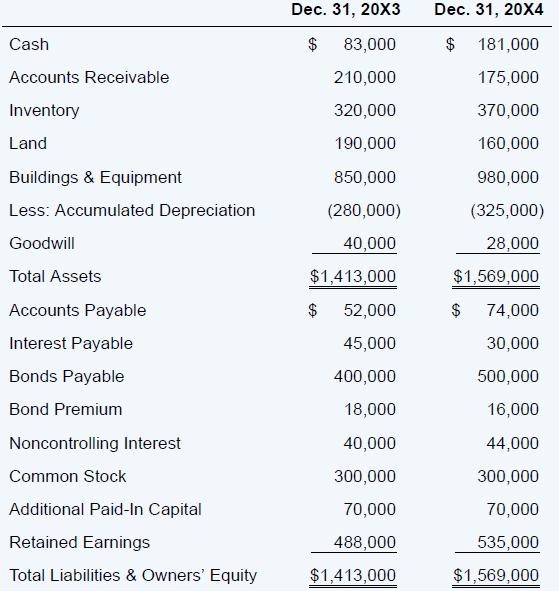

Point Company holds 80 percent ownership of Shoot Company. The consolidated balance sheets as of December 31, 20X3, and December 31, 20X4, are as follows:

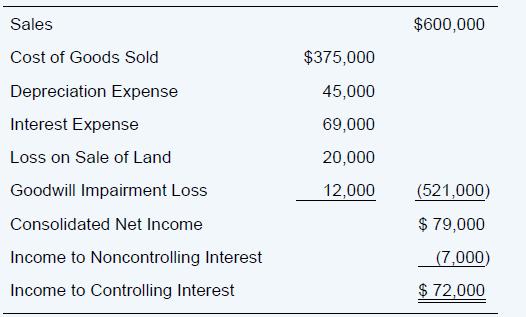

The 20X4 consolidated income statement contained the following amounts:

Point acquired its investment in Shoot on January 1, 20X2, for $176,000. At that date, the fair value of the noncontrolling interest was $44,000, and Shoot reported net assets of $150,000. A total of $40,000 of the differential was assigned to goodwill. The remainder of the differential was assigned to equipment with a remaining life of 20 years from the date of combination.

Point sold $100,000 of bonds on December 31, 20X4, to assist in generating additional funds. Shoot reported net income of $35,000 for 20X4 and paid dividends of $15,000. Point reported 20X4 equity-method net income of $80,000 and paid dividends of $25,000.

Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Goodwill Total Assets Accounts Payable Interest Payable Bonds Payable Bond Premium Noncontrolling Interest Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities & Owners' Equity Dec. 31, 20X3 $ 83,000 210,000 320,000 190,000 850,000 (280,000) 40,000 $1,413,000 $ 52,000 45,000 400,000 18,000 40,000 300,000 70,000 488,000 $1,413,000 Dec. 31, 20X4 $ 181,000 175,000 370,000 160,000 980,000 (325,000) 28,000 $1,569,000 74,000 30,000 500,000 16,000 44,000 300,000 70,000 535,000 $1,569,000 $

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

a b Consolidated statement of cash flows for 20X4 The FASB also requires the following reconciliati... View full answer

Get step-by-step solutions from verified subject matter experts