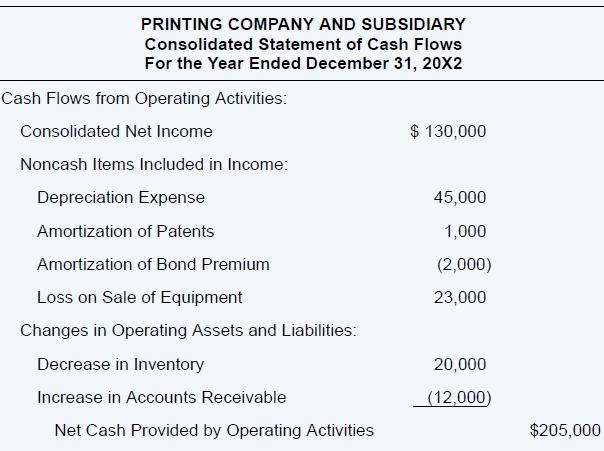

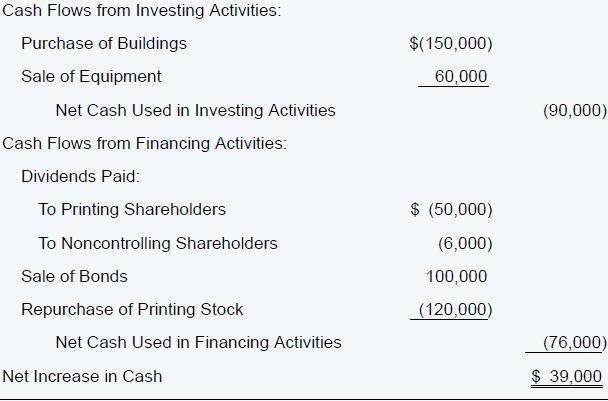

The following 20X2 consolidated statement of cash flows is presented for Printing Company and its subsidiary, Sons

Question:

The following 20X2 consolidated statement of cash flows is presented for Printing Company and its subsidiary, Sons Delivery:

Printing acquired 60 percent of the voting shares of Sons Delivery in 20X1 at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Sons Delivery.

Required

a. Determine the amount of dividends paid by Sons Delivery in 20X2.

b. Explain why the amortization of bond premium is treated as a deduction from net income in arriving at net cash flows from operating activities.

c. Explain why an increase in accounts receivable is treated as a deduction from net income in arriving at net cash flows from operating activities.

d. Explain why dividends to noncontrolling stockholders are not shown as a dividend payment in the retained earnings statement but are shown as a distribution of cash in the consolidated cash flow statement.

e. Did the loss on the sale of equipment included in the consolidated statement of cash flows result from a sale to an affiliate or to a nonaffiliate? How do you know?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd