Question: Using the data presented in P5-28, prepare a solution using the accounting procedures in effect prior to the effective date of FASB 141R. P5-28, Porter

Using the data presented in P5-28, prepare a solution using the accounting procedures in effect prior to the effective date of FASB 141R.

P5-28,

Porter corporation acquired 70 percent of Darla Corporation's common stock on December 31, 20X4, for $102,200. At that date, the fair value of the noncontrolling interest was $43,800. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination, the book values of Darla's assets and liabilities approximated fair value except for inventory, which had a fair value of $81,000, and buildings and equipment, which had a fair value of $185,000. At December 31, 20X4, Porter reported accounts payable of $12,500 to Darla, which reported an equal amount in its accounts receivable.

Required

a. Give the eliminating entry or entries needed to prepare a consolidated balance sheet immediately following the business combination.

b. Prepare a consolidated balance sheet workpaper.

c. Prepare a consolidated balance sheet in good form.

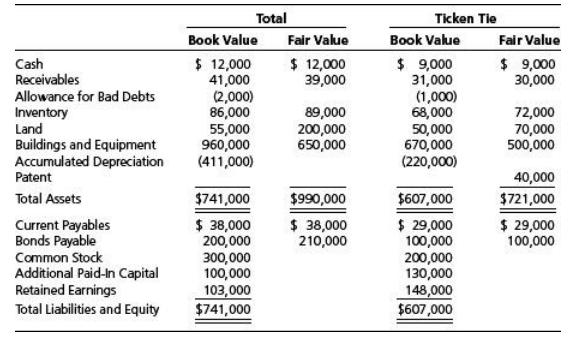

Cash Receivables Allowance for Bad Debts Inventory Land Buildings and Equipment Accumulated Depreciation Patent Total Assets Current Payables Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities and Equity Total Book Value $ 12,000 41,000 (2,000) 86,000 55,000 960,000 (411,000) $741,000 $ 38,000 200,000 300,000 100,000 103,000 $741,000 Fair Value $ 12,000 39,000 89,000 200,000 650,000 $990,000 $ 38,000 210,000 Ticken Tie Book Value $ 9,000 31,000 (1,000) 68,000 50,000 670,000 (220,000) $607,000 $ 29,000 100,000 200,000 130,000 148,000 $607,000 Fair Value $ 9,000 30,000 72,000 70,000 500,000 40,000 $721,000 $ 29,000 100,000

Step by Step Solution

There are 3 Steps involved in it

Solution for P528 using preFASB 141R procedures a Eliminating entries Investment in Darla Corporatio... View full answer

Get step-by-step solutions from verified subject matter experts