Question: Using the data presented in Problem 1-22, prepare the journal entries made by Taylor Corporation to record the business combination as a pooling of interests.

Using the data presented in Problem 1-22, prepare the journal entries made by Taylor Corporation to record the business combination as a pooling of interests.

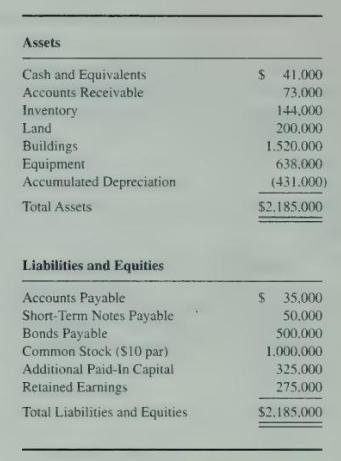

Data From Problem 1-22

Taylor Corporation exchanged shares of its \(\$ 2\) par common stock for all of the assets and liabilities of Mark Company in a planned merger. Immediately prior to the combination, Mark's assets and liabilities were as follows:

Immediately prior to the combination. Taylor reported additional paid-in capital of \(\$ 250,000\) and retained earnings of \(\$ 1,350,000\). The fair values of Mark's assets and liabilities were equal to their book values on the date of combination except that Mark's buildings were worth \(\$ 1,500,000\) and its equipment was worth \(\$ 300,000\). Costs associated with planning and completing the business combination totaled \(\$ 38.000\), and stock issue costs totaled \(\$ 22.000\). The market value of Taylor's stock at the date of combination was \(\$ 4\) per share.

Assets Cash and Equivalents $ 41.000 Accounts Receivable 73.000 Inventory Land Buildings Equipment Accumulated Depreciation Total Assets 144,000 200,000 1.520.000 638,000 (431.000) $2.185.000 Liabilities and Equities Accounts Payable Short-Term Notes Payable Bonds Payable Common Stock ($10 par) $ 35,000 50.000 500,000 1,000,000 Additional Paid-In Capital 325.000 Retained Earnings 275.000 Total Liabilities and Equities $2.185.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts