Using the information in P8.8 , assume that Evergreens functional currency is the dollar. Prepare the financial

Question:

Using the information in P8.8 , assume that Evergreen’s functional currency is the dollar. Prepare the financial statements of Evergreen for the year ended 31 October 20x3 in dollars. Show the consolidated financial statements of Blue Sky Corporation and its subsidiary for the year ended 31 October 20x3.

Data from P8.8

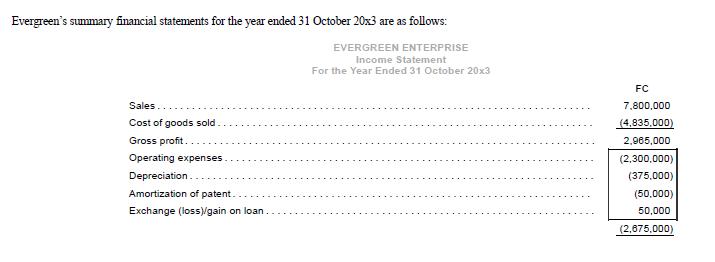

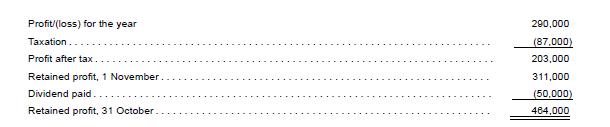

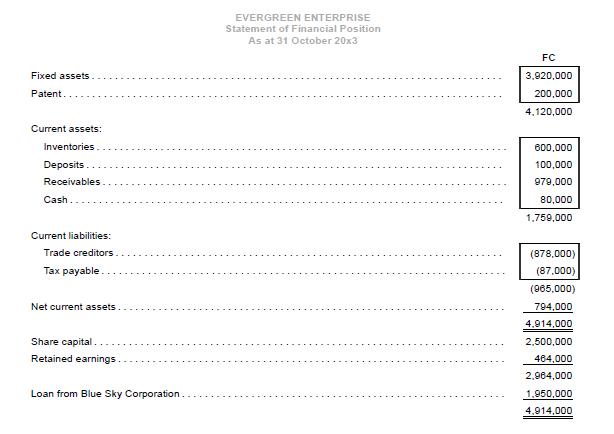

Blue Sky Corporation incorporated a wholly owned subsidiary, Evergreen Enterprise, in country X with an initial paid-up capital of FC 1,500,000 on 1 November 20x1. This was subsequently increased by FC 1,000,000 on 15 December 20x1. Evergreen’s products were marketed principally in country X with the sales invoiced in FC, and the prices determined by local competitive conditions. Expenses (labor, materials and other production costs) were mostly local, although significant quantities of components are imported from Blue Sky. Evergreen Enterprise was Blue Sky’s only subsidiary.

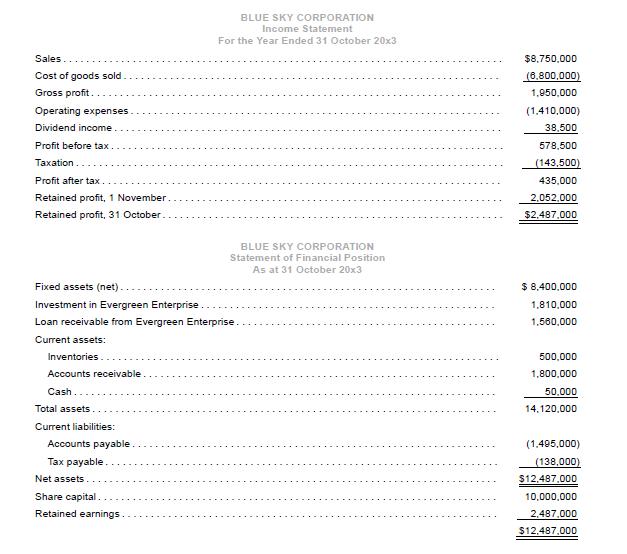

The financial statements of Blue Sky Corporation for the year ended 31 October 20x3 are as follows: The functional and presentation currency of Blue Sky Corporation is the dollar ($).

Additional information

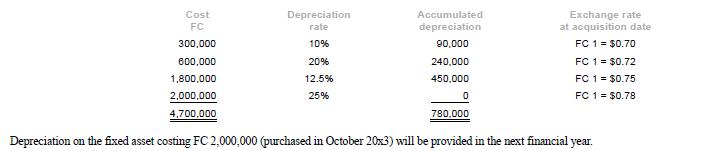

(a) Fixed assets and accumulated depreciation as at 31 October 20x3 are as follows:

(b) Sales, purchases, and operating expenses occurred evenly throughout the period. The exchange rates when opening and closing inventories were acquired are as follows:

(c) The patent was purchased in October 20x2 at a cost of FC 250,000 when the exchange rate was FC 1 = $0.76. The patent was amortized over a period of five years on a straight line basis from 1 November 20x2.

(d) Exchange gain on the loan arose from a loan (denominated in dollars) that Blue Sky Corporation extended to Evergreen Enterprise in August 20x3 (exchange rate FC 1 = $0.78). The loan amount was $1,560,000. The loan carries an interest of 5%, which approximated the market interest rate and has a fixed schedule of repayment. Interest on the loan is payable at 31 December and the interest expense has been included under operating expenses.

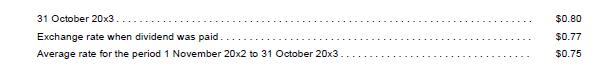

(e) Other relevant exchange rates:

Required

1. Translate the financial statements of Evergreen Enterprise for the year ended 31 October 20x3 for the purpose of consolidation with the accounts of Blue Sky Corporation.

Assume that the FC is the functional currency of Evergreen Enterprise. Show workings for the translation difference. Assume that the the translation reserves at 31 October 20x2 were nil.

2. Prepare consolidation journal entries to consolidate the accounts of Evergreen Enterprise.

3. Show the consolidated financial statements of Blue Sky Corporation and its subsidiary for the year ended 31 October 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah