Question: These quotes apply to all problems UNLESS stated otherwise. The time period is 1 year for all problems. NOK - Norwegian krona. The quotes

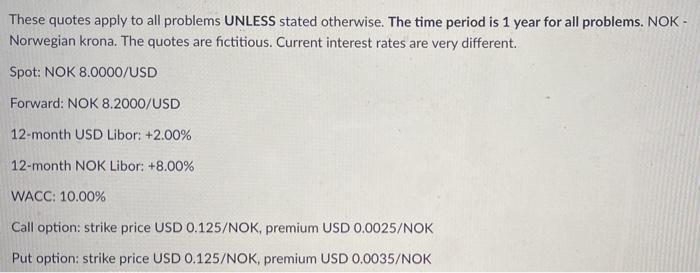

These quotes apply to all problems UNLESS stated otherwise. The time period is 1 year for all problems. NOK - Norwegian krona. The quotes are fictitious. Current interest rates are very different. Spot: NOK 8.0000/USD Forward: NOK 8.2000/USD 12-month USD Libor: +2.00% 12-month NOK Libor: +8.00% WACC: 10.00% Call option: strike price USD 0.125/NOK, premium USD 0.0025/NOK Put option: strike price USD 0.125/NOK, premium USD 0.0035/NOK Compute the profits from the Covered interest rate arbitrage. You can borrow USD 1M or NOK 8M. Compute the final profits in USD and round to the nearest dollar. USE THE TWO LIBOR RATES.

Step by Step Solution

There are 3 Steps involved in it

covered interest rate arbitrage can be used to exploit the interest rate differential between the US... View full answer

Get step-by-step solutions from verified subject matter experts