Assume that the A Corporation can obtain a 10-year noncancellable lease of $12,500 per year for an

Question:

Assume that the A Corporation can obtain a 10-year noncancellable lease of $12,500 per year for an asset that it wants. The lease payment is due at the end of each year. The asset will have zero value at the end of 10 years.

The asset would cost $70,000 if purchased. It will earn gross cash flows of $13,500 per year.

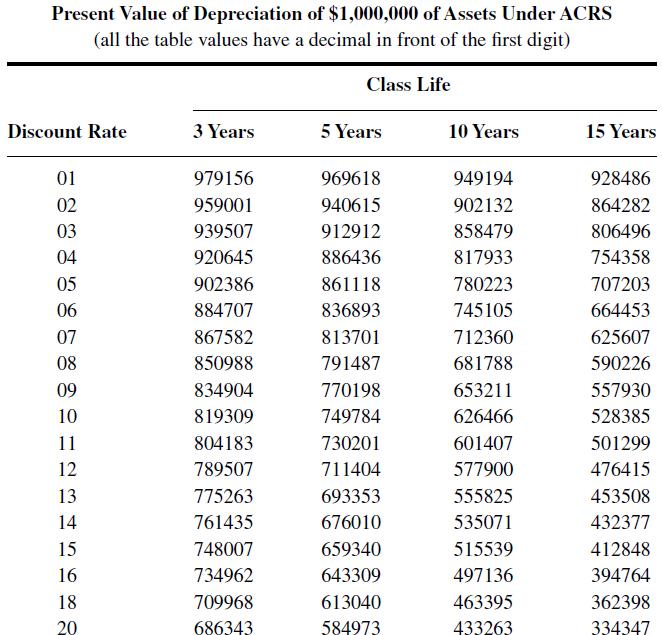

Corporate taxes are 0.35. The asset fits in the 5-year Accelerated Cost Recovery System (ACRS) class life.

The corporation can borrow money repayable in equal installments at an aftertax cost of 0.07. It has a weighted average cost of capital of 0.15.

Assume that the firm has decided to acquire the asset. Assume that the firm is willing to use the after-tax borrowing rate.

The net tax cost of buying is __________.

The net tax cost of leasing is __________.

Step by Step Answer:

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman