During the year 20X2, the Foster Company purchased buildings that cost a total of $3,400,000.The Buildings account

Question:

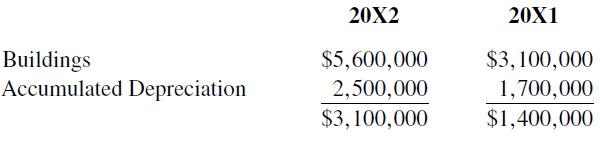

During the year 20X2, the Foster Company purchased buildings that cost a total of $3,400,000.The Buildings account and the related Accumulated Depreciation were shown in the comparative balance sheets of the company as of December 31, 20X1 and 20X2, as follows:

The company’s income statement for the year 20X2 included the following items:

Depreciation of Buildings ............................ $1,200,000

Gain on Sale of Buildings ............................. $ 600,000

Determine the cost of the buildings that were sold during 20X2 and the total amount received from the sale of buildings.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: