The Super Company used a ROFE (return on funds employed) method of evaluating investments. The income of

Question:

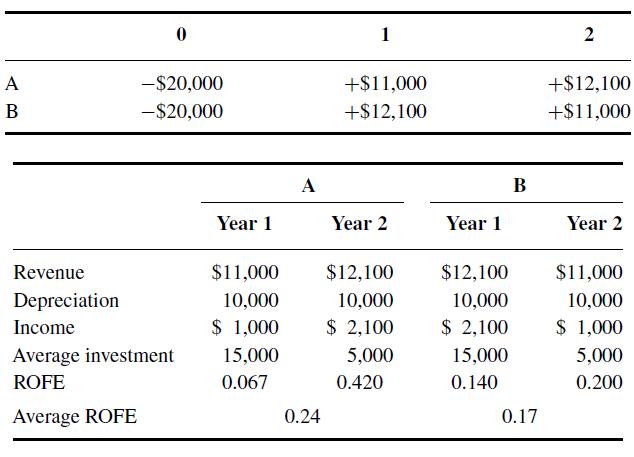

The Super Company used a ROFE (return on funds employed) method of evaluating investments. The income of each period is divided by the average assets used during the period. This is done for each period and then an average ROFE is computed of all the ROFEs.

The controller of the Super Company defends the procedure since it is consistent with the performance evaluation procedures that are used after the investment is acquired.

The company is currently evaluating two investments (A and B).

The firm requires a 0.20 return for an investment to be acceptable. The firm acquired investment A.

Which investment is more desirable?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: