Procureps, Inc. (P) is considering two possible acquisitions, neither of which promises any enhancements or synergistic benefits.

Question:

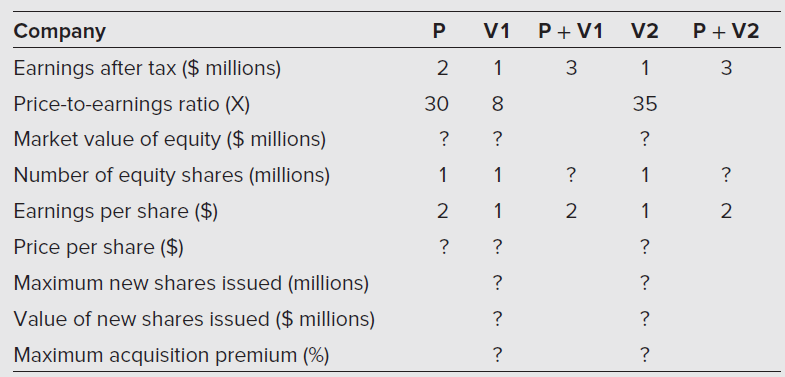

Procureps, Inc. (P) is considering two possible acquisitions, neither of which promises any enhancements or synergistic benefits. V1 is a poorly performing firm in a declining industry with a price-to-earnings ratio of 8 times. V2 is a high-growth technology company with a price-to-earnings ratio of 35 times. Procureps is interested in making any acquisition that increases its current earnings per share. All of Procureps?s acquisitions are exchange-of-share mergers.

a. Calculate the maximum percentage premium Procureps can afford to pay for V1 and V2 by replacing the question marks in the following table.

b. What do your answers to part (a) suggest about the wisdom of using ?avoid dilution in earnings per share? as a criterion in merger analysis?

Step by Step Answer: