This is a continuation of Example 10.4. 1. Determine the NPV and the DCFROR for each increment

Question:

This is a continuation of Example 10.4.

1. Determine the NPV and the DCFROR for each increment of investment.

2. Recommend the best option.

Example 10.4

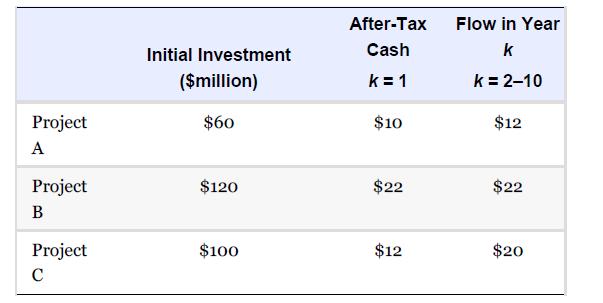

A company is seeking to invest approximately $120 × 10 in new projects. After extensive research and preliminary design work, three projects have emerged as candidates for construction. The minimum acceptable internal discount (interest) rate, after tax, has been set at 10%. The after-tax cash-flow information for the three projects using a ten-year operating life is as follows (values in $million):

For this example it is assumed that the costs of land, working capital, and salvage are zero. Furthermore, it is assumed that the initial investment occurs at time = 0, and the yearly annual cash flows occur at the end of each of the ten years of plant operation.

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting