Question: Big Tree McGee is negotiating his rookie contract with a professional basketball team. They have agreed to a three-year deal which will pay Big Tree

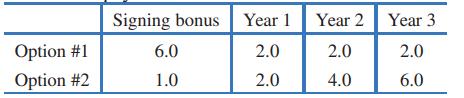

Big Tree McGee is negotiating his rookie contract with a professional basketball team. They have agreed to a three-year deal which will pay Big Tree a fixed amount at the end of each of the three years, plus a signing bonus at the beginning of his first year. They are still haggling about the amounts and Big Tree must decide between a big signing bonus and fixed payments per year, or a smaller bonus with payments increasing each year. The two options are summarized in the table. All values are payments in millions of dollars.

(a) Big Tree decides to invest all income in stock funds which he expects to grow at a rate of 10% per year, compounded continuously. He would like to choose the contract option which gives him the greater future value at the end of the three years when the last payment is made. Which option should he choose?

(b) Calculate the present value of each contract offer.

Option #1 Option #2 Signing bonus 6.0 1.0 Year 1 Year 2 2.0 2.0 2.0 4.0 Year 3 2.0 6.0

Step by Step Solution

3.39 Rating (177 Votes )

There are 3 Steps involved in it

a We calculate the future values of the two options As we can see the first ... View full answer

Get step-by-step solutions from verified subject matter experts