The tax that you pay to the federal government is a percentage of your taxable income, which

Question:

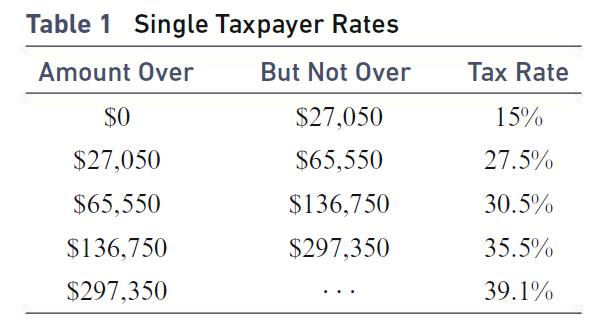

The tax that you pay to the federal government is a percentage of your taxable income, which is what remains of your gross income after you subtract your allowed deductions. In a recent year, there were five rates or brackets for a single taxpayer, as shown in Table 1.

So, if you are single and your taxable income was less than $27,050, your tax is your taxable income times 15% (.15). The maximum amount of tax that you will pay on your income in this first bracket is 15% of $27,050, or (.15) * 27,050 = 4057.50 dollars. If your taxable income is more than $27,050 but less than $65,550, your tax is $4057.50 plus 27.5% of the amount in excess of $27,050. So, for example, if your taxable income is $50,000, your tax is 4057.5 + .275(50,000 - 27,050) = 4057.5 + .275 * 22,950 = $10,368.75. Let x denote your taxable income and T(x) your tax.

(a) Find a formula for T(x) if x is not over $136,750.

(b) Plot the graph of T(x) for 0 ≤ x ≤ 136,750.

(c) Find the maximum amount of tax that you will pay on the portion of your income in the second tax bracket. Express this amount as a difference between two values of T(x).

Step by Step Answer:

Calculus And Its Applications

ISBN: 9780134437774

14th Edition

Authors: Larry Goldstein, David Lay, David Schneider, Nakhle Asmar