Question: Refer to Exercise 27. (a) Find a formula for T(x) for all taxable income x. (b) Plot T(x). (c) Determine the maximum amount of tax

Refer to Exercise 27.

(a) Find a formula for T(x) for all taxable income x.

(b) Plot T(x).

(c) Determine the maximum amount of tax that you will pay on the portion of your income in the fourth tax bracket.

Exercise 27

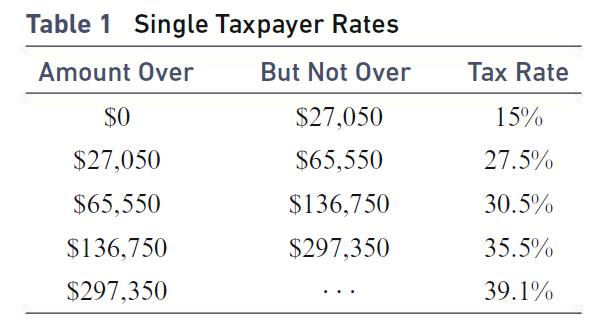

The tax that you pay to the federal government is a percentage of your taxable income, which is what remains of your gross income after you subtract your allowed deductions. In a recent year, there were five rates or brackets for a single taxpayer, as shown in Table 1.

So, if you are single and your taxable income was less than $27,050, your tax is your taxable income times 15% (.15). The maximum amount of tax that you will pay on your income in this first bracket is 15% of $27,050, or (.15) * 27,050 = 4057.50 dollars. If your taxable income is more than $27,050 but less than $65,550, your tax is $4057.50 plus 27.5% of the amount in excess of $27,050. So, for example, if your taxable income is $50,000, your tax is 4057.5 + .275(50,000 - 27,050) = 4057.5 + .275 * 22,950 = $10,368.75. Let x denote your taxable income and T(x) your tax.

Table 1 Single Taxpayer Rates Amount Over But Not Over $0 $27,050 $65,550 $136,750 $297,350 $27,050 $65,550 $136,750 $297,350 .. Tax Rate 15% 27.5% 30.5% 35.5% 39.1%

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

a The function Tx is a piecewisedefined function All together we have b c T297350 T... View full answer

Get step-by-step solutions from verified subject matter experts