Imperiol, a limited liability company, manufactures and distributes electrical and telecommunications accessories, household durables (e.g. sink and

Question:

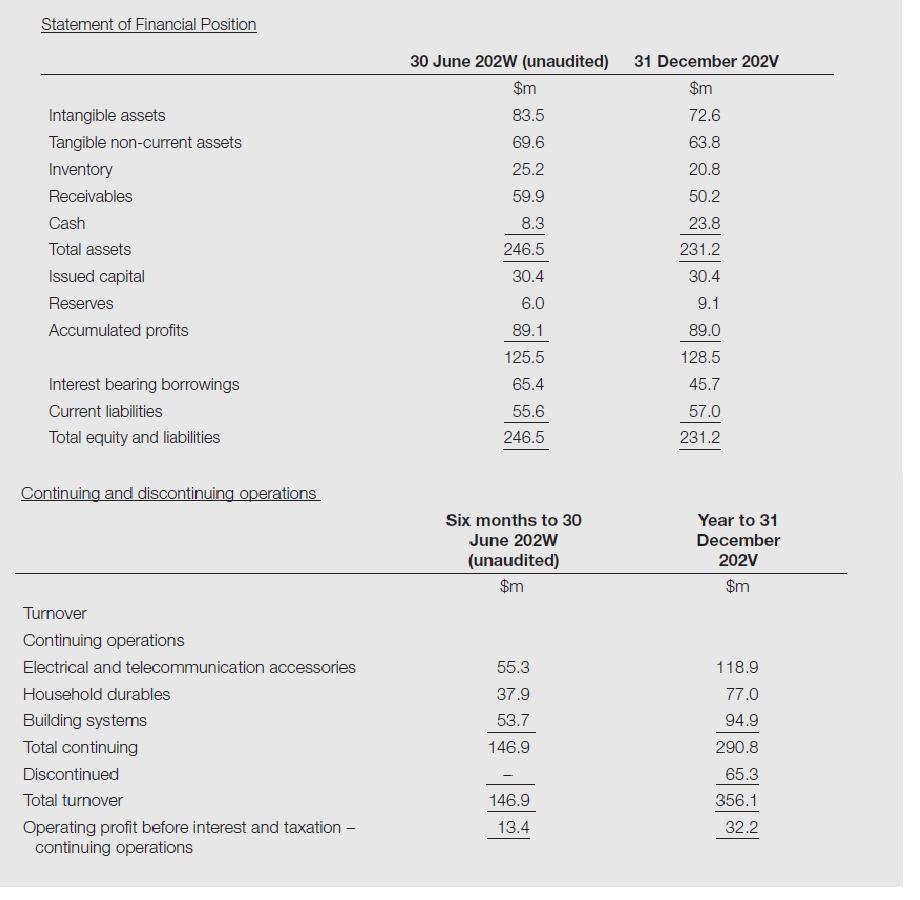

Imperiol, a limited liability company, manufactures and distributes electrical and telecommunications accessories, household durables (e.g. sink and shower units) and building systems (e.g. air-conditioning, solar heating, security systems). The company has undergone several business restructurings in recent years. Finance is to be sought from both a bank and a venture capitalist in order to implement the board's latest restructuring proposals. You are a manager in Peach Wimblehouse LLP, a firm of Chartered Certified Accountants. You have been approached by Paulo Gandalf, the chief finance officer of Imperiol, to provide a report on the company's business plan for the year to 31 December 202X. From a brief telephone conversation with Paulo Gandalf, you have ascertained that the proposed restructuring will involve discontinuing all operations except for building systems, where the greatest opportunity for increasing product innovation is believed to lie. Imperiol's strategy is to become the market leader in providing 'total building system solutions' using new fibre optic technology to link building systems. A major benefit of the restructuring is expected to be a lower ongoing cost base. As part of the restructuring, it is likely that certain of the accounting functions, including internal audit, will be outsourced. You have obtained a copy of Imperiol's Interim Report for the six months to 30 June 202W on which the company's auditors, Discorpio, provide a conclusion giving negative assurance. The following information has been extracted from the Interim Financial Report:

Chairman’s statement: ‘The economic climate is less certain than it was a few months ago and performance has been affected by a severe decline in the electrical accessories market. Management’s response will be to gain market share and reduce the cost base.’

Required:

(a) Explain the matters Peach Wimblehouse should consider before accepting the engagement to report on Imperiol’s prospective financial information.

(b) Describe the procedures that a professional accountant should undertake in order to provide a report on a profit forecast and forecast Statement of Financial Position for Imperiol for the year to 31 December 202X.

Step by Step Answer: