You are auditing the financial statements of Colonial, Inc., a wholesale office supply company, for the year

Question:

You are auditing the financial statements of Colonial, Inc., a wholesale office supply company, for the year ended September 30, 19X0. Your internal control review points out many weaknesses. In examining the accounts receivable, the following information is available as of September \(30,19 X 0\).

1. The accounts receivable general ledger debit balance is \(\$ 780,430\), and the provision for doubtful accounts general ledger debit balance is \(\$ 470\). The total of the accounts receivable in the subsidiary ledger is \(\$ 768,594\).

2. In preparing to confirm accounts receivable, you discover that the accounts vary greatly in dollar amount, and you therefore decide to use a three-strata procedure, as follows:

(a) negative confirmation requests for accounts under \(\$ 200\);

(b) positive confirmation requests, unrestricted random sampling and the technique of estimation sampling for variab'es for accounts of \(\$ 200\) to \(\$ 2,000\); and

(c) positive confirmation requests for all accounts of \(\$ 2,000\) or more.

3. Your review of accounts receivable and discussions with the client disclose that the following items are included in the accounts receivable (both control and the subsidiary):

a. Accounts with credit balances total \(\$ 1,746\).

b. Receivables from officers total \(\$ 8,500\).

c. Advances to employees total \(\$ 1,411\).

d. Accounts that are definitely uncollectible total \(\$ 1,187\).

4. Uncollectible accounts are estimated to be one-half percent of the year's net credit sales of \(\$ 15.75\) million.

5. The confirmations and analysis of the subsidiary ledger provide the following information:

a. The 1,270 subsidiary ledger accounts with balances of less than \(\$ 200\) total \(\$ 120,004\). Twenty-seven confirmations show a net overstatement of \(\$ 970\). The client agrees that these errors were made.

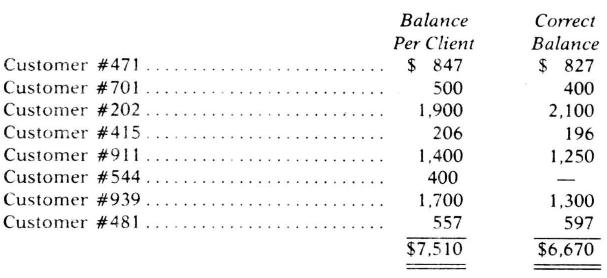

b. The 625 subsidiary ledger accounts with balances of \(\$ 200\) to \(\$ 2,000\) total \(\$ 559,875\). The following errors were reported in the replies received from the random sample of 50 positive confirmation requests (the appropriateness of a sample of 50 items was determined statistically based upon desired levels of precision and reliability and investigation established that the customers were correct):

Subsidiary ledger balances of \(\$ 37,280\) were confirmed in the replies to all of the remaining 42 positive confirmation requests.

c. The 28 accounts with balances of \(\$ 2,000\) and over comprise the remainder of the accounts receivable subsidiary ledger. Investigation established that errors existed in five of these accounts and that the net overstatement is \(\$ 4,570\).

Required:

a. Prepare journal entries necessary (1) to reclassify items which are not trade accounts receivable, (2) to write off uncollectible accounts, and (3) to adjust the provision for doubtful accounts.

b. Using the arithmetic mean of the sample as a basis, prepare a schedule computing an estimate of the dollar amount of the middle stratum of accounts receivable at September 30, 19X0.

c. Assuming that the net adjustment of accounts receivable computed in part

(a) was \(\$ 10,000\) and that the estimate of the middle stratum in part

(b) was \(\$ 600,000\), prepare a schedule computing an estimate of total trade accounts receivable at September \(30,19 X 0\).

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler