Question: Your client, Special Cases, Inc., took its physical inventory at November 30, one month before its December 31, year-end. The client compiled the inventory as

Your client, Special Cases, Inc., took its physical inventory at November 30, one month before its December 31, year-end.

The client compiled the inventory as of November 30 and "carriedforward" the inventory amounts to December 31.

You were present at the taking of the physical inventory and you satisfied yourself that the inventory was properly counted. All goods received up to and including November 30 were counted. Listings prepared at the time of your observation have been traced to the compiled inventory and no differences were noted. The compiled physical inventory at November 30 amounted to \(\$ 582,000\).

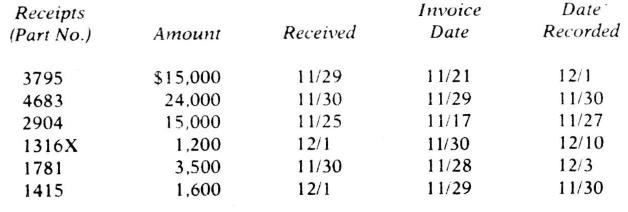

At the time of your observation and from subsequent review of the company's records, you have obtained the following cutoff information:

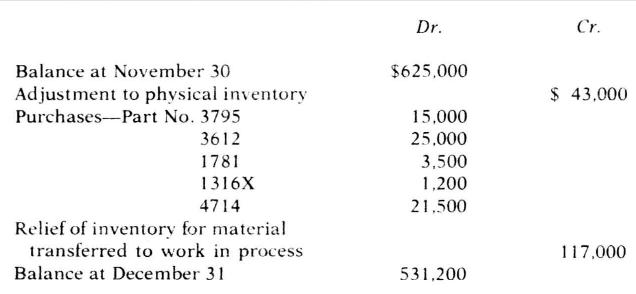

The following shows the activity in the raw material inventory account from November 30 to December 31 :

Required:

a. List those procedures you would employ in testing an inventory "carryforward."

b. List the adjustments, if any, that should be made at December 31. Compute the actual difference between the book and physical inventory at November 30.

c. State why it is desirable to test the shipping and receiving cutoff at November 30 and December 31.

d. List any internal control weaknesses noted from the facts presented.

Receipts Invoice Date (Part No.) Amount Received Date Recorded 3795 $15,000 11/29 11/21 12/1 4683 24.000 11/30 11/29 11/30 2904 15,000 11/25 11/17 11/27 1316X 1,200 12/1 11/30 12/10 1781 3,500 11/30 11/28 12/3 1415 1,600 12/1 11/29 11/30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts