Question: Answer the following questions based on the information presented for Cloud 9 in the appendix to this text and the current and earlier chapters. You

Answer the following questions based on the information presented for Cloud 9 in the appendix to this text and the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters.

Effective internal controls at the transaction level are designed to prevent or detect material misstatements that could occur within the flow of transactions. In the case study assignment in chapter 6, you were required to identify potential misstatements and affected financial report assertions within the wholesales sales to cash receipts process.

Required

(a) Use your worksheet from the case study assignment in chapter 6 to complete this part of the assignment. In column four, include the transaction-level internal controls Cloud 9 has implemented to prevent and/or detect potential errors.

(b) In designing the audit strategy, auditors should consider the effectiveness of the client’s internal control structure, thereby determining the control risk. An auditor should perform a preliminary assessment of control risk to give confidence to take a controls-based approach to the audit strategy. A controls-based strategy is one in which the internal controls of a significant process are tested and proven to be effective and, therefore, can be relied upon to reduce the level of substantive testing needed.

If internal controls are tested and proven to be operating effectively, the auditor can reduce the control risk of the related financial report assertion. This method of testing and proving controls can reduce the substantive procedures to be performed or allow substantive testing to be performed prior to year-end.

When designing control tests, consider whether there will be sufficient evidence that the control:

• operated how it was understood to operate • was applied throughout the period of intended reliance • was applied on a timely basis • encompassed all applicable transactions • was based on reliable information • resulted in timely correction of any errors that were identified.

Based on the preliminary assessment of Cloud 9’s control environment obtained in earlier procedures, the audit team has decided to test controls over the sales to cash receipts process. It is expected that there will be no deficiencies in the transaction-level internal controls.

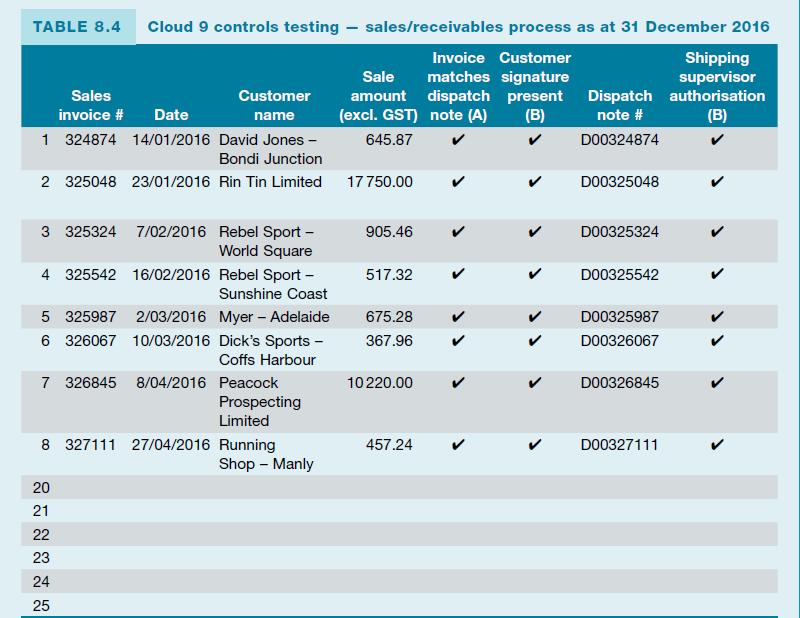

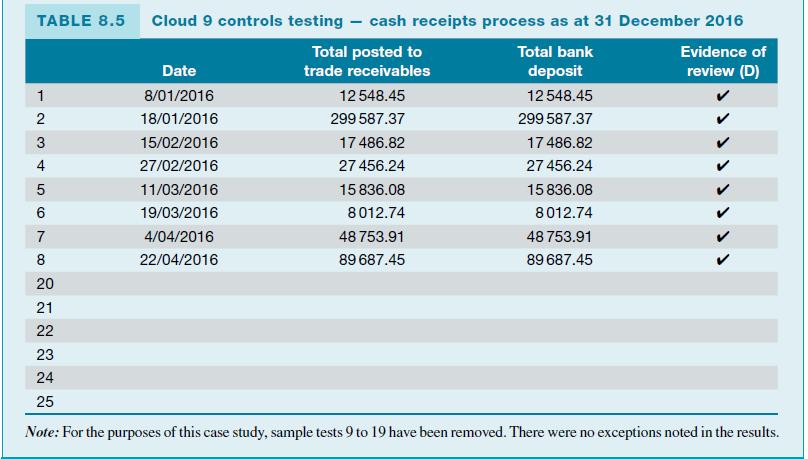

Josh has partially completed the testing for selected controls over the sales/receivables and cash receipts processes. He has asked you to complete the testing for him. All information has been provided by the client (refer to the appendix to this text). Document your findings on the workpapers Josh has started (see tables 8.4 and 8.5 below) and then conclude with your assessment on the overall effectiveness of the controls tested.

Aim: To test selected controls over the sales and receivables process.

Sample: We haphazardly selected 25 sales invoices from the entire year.

Complete the following audit procedures:

• Match the quantities and products ordered on the invoices to the dispatch notes. If they match, mark all matching lines on both documents with the letter ‘A’.

• Check the dispatch notes for a signature by the customer. If a signature is present, mark the signature with a ‘B’.

• Check the invoice contains a passcode entered by the supervisor. If a passcode is present, mark the code with a ‘C’.

Aim: To test selected controls over the cash receipts process.

Sample: We haphazardly selected 25 working days from the entire year in order to test the reconciliation of daily bank receipts to trade receivables.

Match the total amount of the bank receipts to the accounts receivable postings. If the amounts match, mark with a ‘D’ on both documents.

TABLE 8.4 Cloud 9 controls testing - sales/receivables process as at 31 December 2016 Invoice Customer Shipping Sale matches signature supervisor amount dispatch present Dispatch authorisation (excl. GST) note (A) (B) note # (B) 645.87 D00324874 Sales invoice # Date 1 324874 14/01/2016 David Jones - Bondi Junction 2 325048 23/01/2016 Rin Tin Limited 17750.00 Customer name 3 325324 7/02/2016 Rebel Sport - World Square 4 325542 16/02/2016 5 325987 2/03/2016 6 326067 10/03/2016 20 21 22 23 24 25 Rebel Sport - Sunshine Coast Myer - Adelaide Dick's Sports - Coffs Harbour 7 326845 8/04/2016 Peacock Prospecting Limited 8 327111 27/04/2016 Running Shop - Manly 905.46 517.32 675.28 367.96 10 220.00 457.24 D00325048 D00325324 D00325542 D00325987 D00326067 D00326845 D00327111

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Solutions Step 1 To determine how many external financing the company needs to buy a 25 increase in promoting the business one needs to look into the ... View full answer

Get step-by-step solutions from verified subject matter experts