Your client is BigC Ltd., a large private firm with offices in all major cities of Canada.

Question:

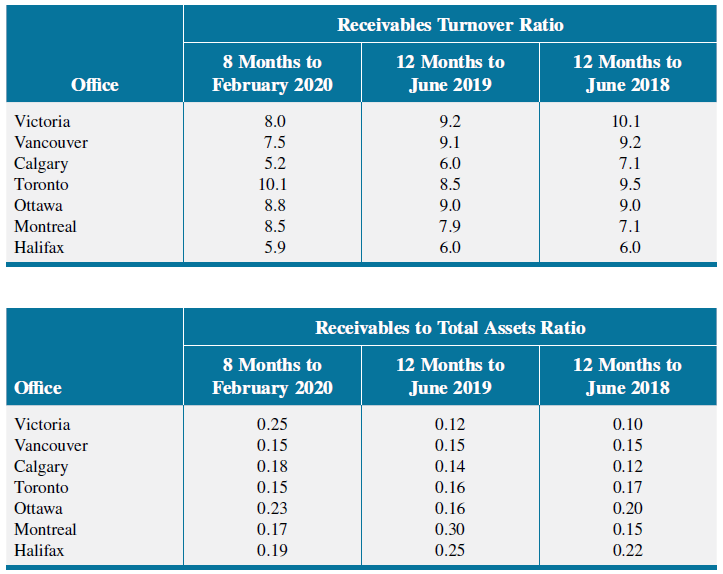

Your client is BigC Ltd., a large private firm with offices in all major cities of Canada. BigC specializes in selling concentrated fruit juices to Canadian and overseas buyers. This is the first year your firm will perform the audit. You are currently completing the planning work for the audit of accounts receivable for the year ending June 30, 2020, and have gathered the following information:

1. The Vancouver office recently won a large contract to supply an overseas supermarket chain with concentrated orange juice.

2. For the month of January, the Toronto office ran a sales promotion that allowed new customers double the normal credit terms of 30 days. Several new large customers took advantage of this off er.

Required

a. List the questions you would ask of management in relation to the accounts receivable of each of the branch offi ces.

b. Describe additional audit work you would perform to satisfy yourself that accounts receivable were fairly stated.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Auditing A Practical Approach

ISBN: 978-1119566007

3rd Canadian edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton, Valerie Warren