Flash Technologies, Inc. has recently engaged your firm to perform the annual audit for the year ending

Question:

Flash Technologies, Inc. has recently engaged your firm to perform the annual audit for the year ending December 31, 2008. Flash has determined that its current auditors, Adams & Adams LLP, cannot provide the international support that Flash now requires with its increased investment in Korea and Canada. Partners from your firm have discussed the prior audits with the engagement partner at Adams & Adams, and everything seems to be in order. Your firm also met with executives at Flash in December 2008 and January 2009 and a verbal (but informal) agreement was reached regarding fees, timing, scope, etc. Your firm has decided that additional analyses are needed before finalizing the details of the engagement (assume that it is now late January 2009). On the following pages you will find (l) two memos from the audit manager of your firm to the planning files regarding background information and questions/concerns the client would like the firm to address, (2) industry articles, (3) industry ratios, and (4) the draft annual report for fiscal year 2008 that Flash has prepared. Your firm demands polished, concise, professional analyses and writing. Be thorough, but get to the issues without unnecessary verbiage. In describing your analyses and conclusions, please use relatively short, “punchy,” or to-the-point sentences. Paragraphs should probably not contain more than about 5 sentences. You may want to organize your risk analysis around categories like General Areas of Risk (e.g., foreign ventures, etc.), Industry Risks, and Specific Financial Statement Risks (e.g., significant or unusual increases in ending balances). Please use headings appropriately and consider using bullet point listings. Exhibits should be referred to in the body of the report and should not include unnecessary detail. Your instructor will provide further guidance on the length and format of the report. Emanuel “Manny” Schwimez, is the CEO and chairman of the board of Flash. Mr. Schwimez is originally from Tel Aviv. He has an impressive resume, including a master’s degree from the London School of Economics and many years of executive-level experience. He has led several high technology companies in the U.S. and abroad since the early 1970’s. In 1990 he became president of Seatac Inc., a start-up company in Seattle, Washington, which manufactured and sold font cartridges for printers. In 1993 Seatac agreed to merge with Boston Printing of Massachusetts. In 1994 the combined company was incorporated in Massachusetts as Flash Technologies, Inc., and began developing and commercializing font cartridges for laser printers. Headquarters for the company are in Binex, MA. Beginning in 1999 the company began to shift its emphasis from font cartridges to the growing PC card market. A PC card is a rugged, lightweight, credit card sized device inserted into a dedicated slot in a broad range of electronic equipment that contain microprocessors, such as portable computers, telecommunications equipment, manufacturing equipment, and vehicle diagnostic systems. The company was an early adopter of the new ExpressCard™ standards used on all new portable and desktop computers. Although Flash Technologies, Inc., is still a relatively small player in the industry, it has enjoyed impressive success. The company’s stock price has grown 300% over the last 5 years. In 2003 Flash’s stock graduated to the New York Stock Exchange. The stock recommendation from analysts following Flash’s stock is currently “strong buy." However, I did some market research and noticed short positions in Flash stock have increased during November and December 2008. While I was researching the stock, I visited the Google™ Groups Page and located information on Flash Technologies. The Groups Page is a place where interested parties can discuss the future prospects of the company and share information about it with others. The Groups Page is not connected in any way with the company, and any messages are solely the opinion and responsibility of the poster. Most of the posts on the Groups Page are positive and suggest investors are bullish on Flash stock. However, there were a few posts from someone who goes by the penname, “Mr. Truth,” that were very negative with respect to Mr. Schwimez. Mr. Truth calls Schwimez a “pathological liar” and referred to alleged wrong doings by Mr. Schwimez in the late 1960’s when he was a journalist for an Israeli newspaper and in the 1970’s when Schwimez was an executive with a Swiss company in Geneva. To this point, our local background checks for Mr. Schwimez (e.g., local bankers, attorneys, business associates, vendors, etc.) have been positive. I mentioned the negative allegations to the chief financial officer (CFO), Jane Murphy, and she indicated that she had also heard similar allegations. She indicated that Mr. Schwimez is an aggressive, successful businessman and that because of his particular style of business not everyone likes him. Ms. Murphy believes the allegations are baseless and are simply the result of envy and jealousy. Although the CFO is probably correct, we may want to conduct a more thorough background check on Mr. Schwimez. New Product In the 4th quarter of 2008 Flash began shipping a new product “Flashwall 2008.” It is a computer encryption device for notebook computers. Sales for fiscal year 2008 amounted to about $2 million. The company is attempting to keep the details of this card relatively quiet for a few more months for competitive reasons. Due to design advances developed by Flash’s research and development team, these new cards have an extremely low cost (less than $20). However, they are currently selling for about $300. To date, all sales of Flashwall 2008 have been made to one customer, CCB Computers, which is located in New Hampshire. Mr. Schwimez indicated that CCB and Flash have an excellent working relationship. The president of CCB, Andrew Jolsen, is a long-time associate of Mr. Schwimez. Mr. Jolsen will be joining Flash’s Board of Directors within the next few months.

Plant Tour After a December 23rd meeting with Flash, I visited the Massachusetts manufacturing facility just outside Binex. This is one of the original manufacturing facilities and thus is not as “leading edge" as Flash’s other manufacturing facilities around the world. I was somewhat surprised at how much of the product is still assembled manually. I saw a lot of people assembling PC Card cases with rubber mallets. Nonetheless, I was generally impressed with the organization and efficiency of the facility. It appeared employees were well trained. In one assembly line, I was particularly interested in the inspection team over product quality. They were examining the welds on the flash card casings. I watched the process for several minutes (and several hundred flash cards) noting no faulty product during that time. I examined a casing that was in the “reject” bin due to a failed weld. When a weld did fail, the inspection team member indicated most of the time the casing could be rewelded without any spoilage. I noticed all the reject casings were empty (no electronics inside). An inspection team member told me that after the casings are inspected and rejected, the “insides” are removed for cleaning and are then carefully reprocessed in a static-free environment.

In the employee dining area, I overheard some disgruntled employees talking about the pressure they were under to ship customer items. When I inquired further, I was informed that Mr. Schwimez had just decided to send out large holiday baskets of fruit and candy to show the company’s appreciation to valued customers. Because of the rush to get the baskets in the overnight mail, Mr. Schwimez asked the shipping department to take care of the packing and shipping. Employees indicated that what Mr. Schwimez wants, he gets.

Major Contract Mr. Schwimez informed me that Flash is close to sealing a deal with AT&T for a satellite tracking system for truck fleets that could be worth up to $300 million. Fie is very excited about the deal and believes it will really put Flash Technologies “on the map.” Fie indicated that when the formal announcement is made it should boost the stock price even higher. Because the deal is so close to completion, he has been disclosing the information to investors and some in the financial press. Industry publications have mentioned the possibility of a big AT&T contract for such a tracking system, but AT&T has thus far declined comment and no agreement has been announced.

SEC Investigation The CFO, Ms. Murphy, informed me that Flash has received informal notification from the SEC that it is performing a review of Flash’s financial statement filings. The client has indicated this is a routine process that is common for rapidly growing companies, particularly high technology companies. The CFO indicates that many high technology companies have recently received comment letters regarding their accounting for in-process R&D. In our January 19th meeting with Flash, management asked our firm to respond to the following questions and issues:

1. Management would like to know if footnote disclosure will be required for the Design Circuits, Inc. (DCI) purchase which is expected to take place in February (the purchase is included in the management discussion of the draft annual report). We need to research subsequent-event auditing standards. If it appears disclosure will be required, the client would like us to draft the footnote disclosure. If we need to draft a footnote, we can refer to the AlCPA’s “Accounting Trends and Techniques” or look at other financial statements with similar footnotes on the SEC’s EDGAR Internet website for examples of subsequent events footnotes.

2. As Flash has enjoyed more success, it has noticed legal activity has increased. Although no formal lawsuits have been filed, Flash is aware of one potential lawsuit that may accuse Flash of patent infringement. It seems likely that the lawsuit will be filed before spring. Although management is confident its card designs and manufacturing techniques do not infringe on patents held by others, they would like us to inform them of disclosure requirements.

3. Our firm has also been asked to comment on Flash’s reporting of gains related to one of its foreign currency transactions. The CFO, Jane Murphy, has indicated that the company is pleased that it will report a gain related to foreign currency exchange for 2008. A review of the facts reveals that on November 1, 2008 Flash entered into a contract to purchase materials from a Korean supplier. The exchange rate as well as the 2-month forward rate on November 1 were 200 Won = $1 U.S., so on this date Flash recorded a payable of $4,000,000 (800,000,000 4- 200)

. Terms of the purchase contract are that Flash paid the supplier 800,000,000 Korean won on January 14, 2009. On November 1, 2008 Flash also entered into a futures contract requiring it to buy 800,000,000 Korean won on January 14, 2009 at a fixed price of 200 won per $1 U.S. The purpose of this contract was to hedge the anticipated payment in 2009. At December 31, 2008 the exchange rate had changed to 213.33 won = $1 U.S. (this exchange rate and the forward rate remained unchanged at January 14, 2009), thus the CFO points out that Flash can settle the payable for an amount less than the $4,000,000 recorded on the balance sheet and she wants to report this savings as a gain on the income statement. Currently the draft financials do not report the gain on the contract or disclose the company’s derivative position. However, Ms. Murphy has explained to top management the good news that FASB standards will allow Flash to report this gain as of December 31,2008. Flash’s foreign currency guru, Gary Ryan, commented that the purpose of the futures contract is to hedge against fluctuations and typically any gain or loss in the derivative contract should be offset by a gain or loss in the underlying hedged item and that is why he thought the accounting group asked him to provide so much documentation about the transaction in advance. The accounting supervisor has privately indicated to us that he is concerned about inappropriately reporting the derivative position..............

REQUIRED [1] Provide written recommendations in response to each of the issues the client has identified (see the “Client Issues” audit memo). In your response to the third client issue, please consider these questions:

• Assuming such a transaction could qualify for hedge accounting, what type of hedge would it be (i.e., cash flow or fair value)?

• Propose the correct journal entries for this transaction assuming its proper hedge classification.

• To qualify for hedge accounting, what sort of documentation does the client need to have in place and when?

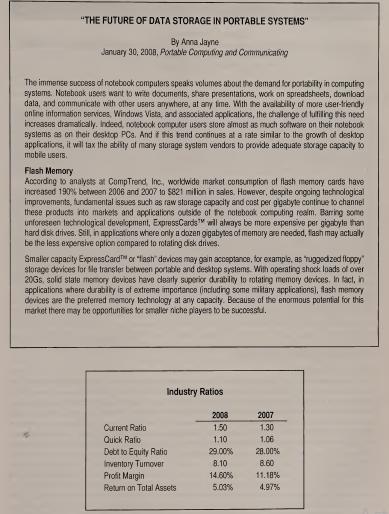

[2] Perform a risk analysis of Flash Technologies and document your findings in a written report. A report like this would be used as a foundation document for engagement planning and client meetings. Using only the information provided in the case (e.g., memos, annual report, and articles), describe the key business risks Flash faces and the key audit risks your firm faces. (Please focus primarily on factors that will influence acceptable audit risk and inherent risk.) In describing the key inherent risks, please be sure to discuss why a factor represents a risk, and then briefly discuss what implications that particular risk will have on the audit. Auditors are required to specifically assess the risk ofmaterial misstatement whether caused by error or fraud. The following AICPA Professional Standards may be useful references for your risk analysis: AU 311, “Planning and Supervision,” AU 312, “Audit Risk and Materiality in Conducting an Audit,” and AU 316, “Consideration of Fraud in a Financial Statement Audit.” To help you identify critical risk factors, you may also wish to perform analytical procedures based on the company’s financial data and compare those results to your expectations and general industry ratios and trends.

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 978-0132423502

4th Edition

Authors: Steven M Glover, Douglas F Prawitt