Southeast Shoe Distributor (SSD) is a closely owned business that was founded 10 years ago by Stewart

Question:

Southeast Shoe Distributor (SSD) is a closely owned business that was founded 10 years ago by Stewart Green and Paul Williams. SSD is a distributor that purchases and sells mens, women’s, and children’s shoes to retail shoe stores located in small- to mid-size communities. The company’s basic strategy is to obtain a broad selection of designer-label and name brand merchandise at low prices and resell the merchandise to small, one-location, retail stores that have difficulty obtaining reasonable quantities of designer and name brand merchandise. The company is able to keep the cost of merchandise low by (l) selectively purchasing large blocks of production overruns, overorders, mid- and late- season deliveries and last season’s stock from manufacturers and other retailers at significant discounts, (2) sourcing in-season name-brand and branded designer merchandise directly from factories in Brazil, Italy, and Spain, and (3) negotiating favorable prices with manufacturers by ordering merchandise during off-peak production periods and taking delivery at one central warehouse.

During the year the company purchased merchandise from over 50 domestic and international vendors, independent resellers, manufacturers and other retailers that frequently had excess inventory. Designer and name brand footwear sold by the company during the year include the following: Amalfi, Clarks, Dexter, Fila, Florsheim, Naturalizer, and Rockport. At the current time, SSD has one warehouse located in Atlanta, GA. Last year, SSD had 123 retail shoe store customers and had net sales of $7,311,214. Sales are strongest in the second and fourth calendar-year quarters, with the first calendar-year quarter substantially weaker than the rest.

BACKGROUND SSD is required to have an audit of its annual financial statements to fulfill requirements of loan agreements with financial institutions. This audit is to be completed in accordance with the AICPA professional standards for the audit of nonpublic companies. Your audit firm is currently planning for the Fiscal 2008 audit in accordance with these professional standards. SSD has the following general ledger accounts related to sales and cash collection activities:

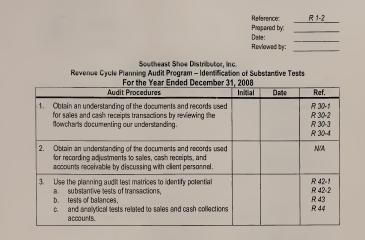

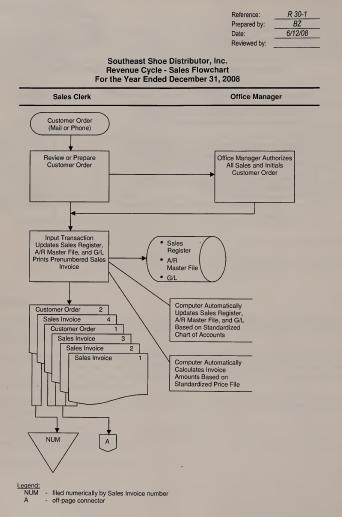

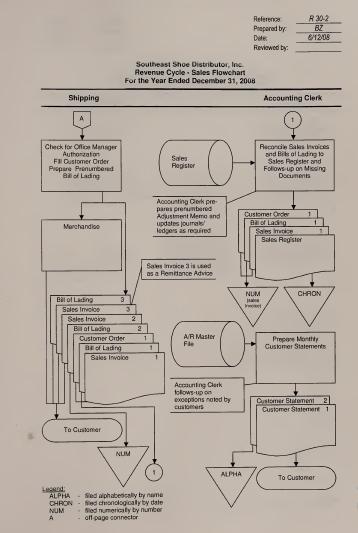

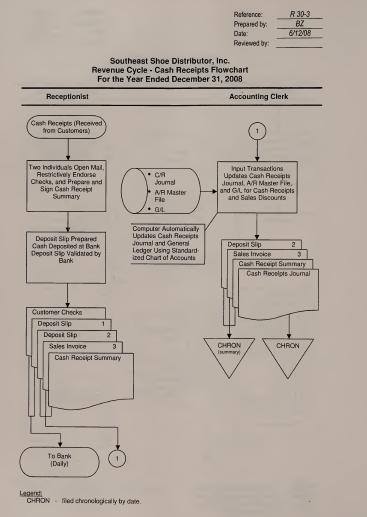

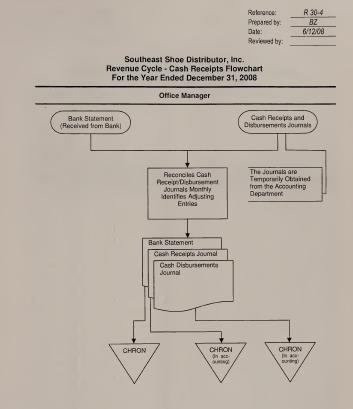

■ Sales ■ Uncollectible Accounts Expense ■ Sales Discounts ■ Accounts Receivable ■ Sales Returns and Allowances ■ Allowance for Uncollectible Accounts Bill Zander, staff auditor, reviewed SSD’s information system and control activities related to sales and cash receipts and prepared the enclosed flowcharts (referenced in the top right hand corner as R 30-1, R30-2, R 30-3, and R 30-4). The number and size of sales returns and uncollectible accounts is relatively small. Thus Susan Mansfield, audit partner, decided not to have Bill document the company’s policies and procedures related to sales returns and allowances and uncollectible accounts.

As the audit senior, you have been assigned responsibility for identifying substantive tests to detect material misstatements related to revenue cycle accounts. You have conducted some preliminary discussions with client personnel and noted the following:

■ Sales returns and allowances transactions are recorded in the sales register.

■ Sales discounts are recorded in the cash receipts journal.

■ The estimation and write-off of uncollectible accounts are recorded in the general journal and require preparation of a prenumbered adjustment memo.

■ Misstatements to sales, cash receipts, and accounts receivable are recorded in the general journal and require preparation of a prenumbered adjustment memo.

REQUIRED [1] Complete audit steps 1 and 2 from the audit program R 1-2 to obtain an understanding of the documents and records used by SSD for sales and cash transactions. Document completion of your work in audit schedule R 1-2.

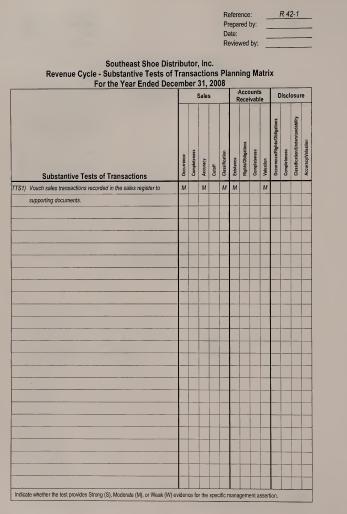

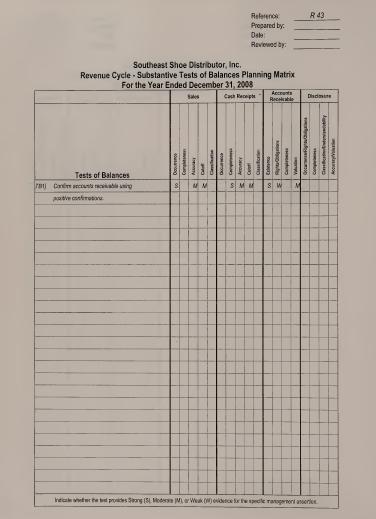

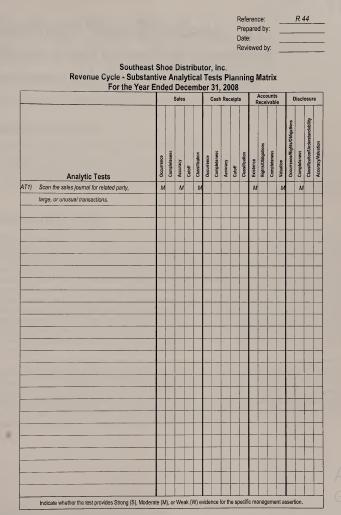

[2] Identify potential substantive tests by completing steps 3a, 3b, and 3c from the audit program R 1 -2. Document your work in audit schedules R1-2,R 42-1, R 42-2, R 43 and R 44 and number your tests by following the examples provided. Each of these steps can be completely separately at the discretion of your instructor.

[3] What are some of the factors that influence the level of assurance obtained through substantive audit tests?

[4] For a given account, why might an auditor choose to:

[a] not conduct substantive tests?

[b] conduct only substantive tests?

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 978-0132423502

4th Edition

Authors: Steven M Glover, Douglas F Prawitt