Late in the calendar year, Shallow and Shallow, a regional CPA firm, was approached by Undermyne Computers,

Question:

Late in the calendar year, Shallow and Shallow, a regional CPA firm, was approached by Undermyne Computers, Inc., a developer of innovative computer software, about changing auditors. Crest and Crest, another regional CPA firm, had been Undermyne's auditor since Undermyne listed its stock on the New York Stock Exchange several years ago.

Myron Shallow, the managing partner, held initial conversations with Stewart Marketo, who was president and majority stockholder of Undermyne Computers, Inc. The conversations were cordial until Shallow raised the question of why Crest and Crest was being replaced. Mr. Marketo was adamant in asserting that the sole basis for his "firing of Crest and Crest" was a disagreement on proper accounting procedures for several million dollars of software development costs of products whose marketability was showing signs of waning. Mr. Marketo insisted that these development costs continue to be amortized over the estimated original life of the software that was established when the products were conceived. Crest and Crest disagreed, maintaining that the amortization period should be shortened considerably, or perhaps the costs should be written off this year as a charge against earnings.

A week later, Mr. Shallow received a call from the managing partner of Crest and Crest who wished to discuss the audit of Undermyne Computers, Inc. Mr. Shallow indicated that his firm was still giving consideration to accepting the audit of Undermyne Computers, Inc., even though he had some reservations about the accounting treatment for Undermyne's software development costs. The managing partner of Crest and Crest described the many problems encountered during prior-year audits. He hinted strongly that continued amortization of certain computer-development costs would create serious problems for any further auditor of Undermyne Computers, Inc.

Mr. Shallow and the other partners of Shallow and Shallow considered the matter for several days and decided to accept the audit but to insist that the controversial computer development costs be examined carefully.

Required:

a. Create the sequence of events that should have occurred when Mr. Shallow was approached by Undermyne Computers, Inc. to consider the audit of that company.

b. All things considered, explain why Shallow and Shallow should or should not have accepted the audit.

During the next two weeks, Mr. Shallow had a number of conversations with Mr. Marketo about the scope of the audit. Although Mr. Marketo insisted that an engagement letter was "a waste of time and paper" because other services might be rendered by the CPA firm, Mr. Shallow believed that a nominal letter should be sent. The letter contained the following comments:

This will confirm our arrangements with you to perform a variety of services for you during the coming calendar year, some of which will be determined at a later time.

As part of the audit portion of our services, we will assess the company's existing internal control. However, there may be errors and fraud that we will not detect.

The charges for our services will be determined after all services are performed.

If these arrangements are in accordance with your understanding, please sign and return to us the enclosed copy of this letter. We appreciate this opportunity to be of service to you.

Required:

c. Describe the errors and omissions in this engagement letter.

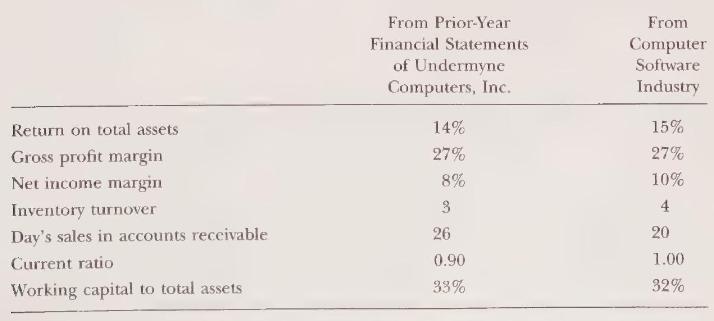

During the planning stage of the audit, the following data were gathered on Undermyne Computers, Inc. and the industry in which it operates.

Required:

d. Based on the above data, the other facts in the case, and your knowledge of the computer software market, describe the areas in which the auditors of Undermyne Computers, Inc. should concentrate their audit efforts. Do not list any specific audit procedures.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor