The following questions concern auditor responsibilities related to the assessment of risks of material misstatement. Choose the

Question:

The following questions concern auditor responsibilities related to the assessment of risks of material misstatement. Choose the best response.

a. Which of the following procedures would a CPA most likely perform during the planning stage of the audit?

(1) Evaluate the reasonableness of management’s allowance for doubtful accounts.

(2) Determine areas where there is a higher risk of material misstatement.

(3) Evaluate the significance of uncorrected misstatements. (4) Confirm a sample of accounts receivable.

b. Dan, CPA, has been engaged to audit Modern Home, a manufacturing company that specializes in furniture. Which of the following matters related to the year under audit would most likely result in an increase of inherent risk?

(1) The furniture industry has experienced an overall increase in demand.

(2) Modern Home recently engaged in a complex derivative transaction.

(3) Modern Home experienced an increase in working capital.

(4) Modern Home purchased expensive new equipment in the current year.

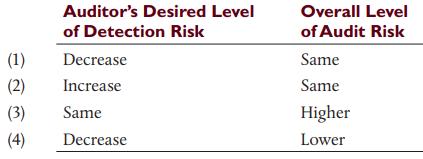

c. After making a preliminary assessment of the risk of material misstatement during planning and beginning to apply audit procedures, an auditor determines that this risk is actually higher than anticipated. Which would be the most likely effect of this finding on the auditor’s desired level of detection risk and the overall level of audit risk, as compared to the levels originally planned?

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780135176146

17th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley