After finding that the old boiler has an efficiency of only 60 percent, whereas a new boiler

Question:

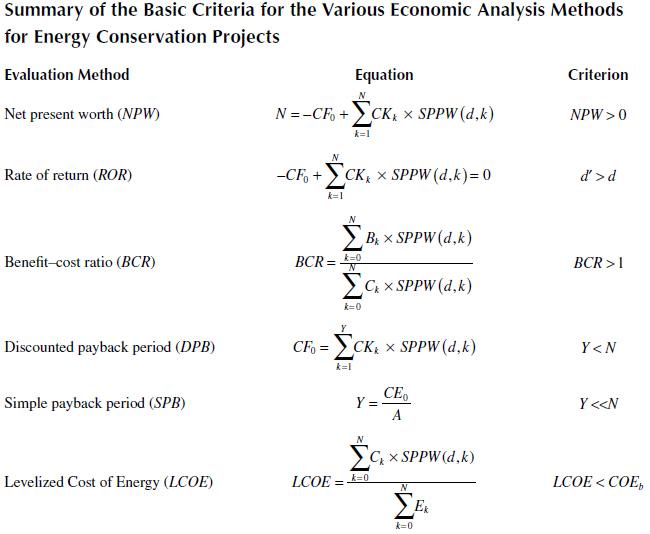

After finding that the old boiler has an efficiency of only 60 percent, whereas a new boiler would have an efficiency of 85 percent, the building owner in Example 3.1 has decided to invest the $10,000 in getting a new boiler. Determine whether this investment is cost-effective if the lifetime of the boiler is ten years and the discount rate is 5 percent. The boiler consumes 5,000 gallons/year at a cost of $1.20/gallon. An annual maintenance fee of $150 is required for the boiler (independent of its age). Use all five methods summarized in Table 3.4 to perform the economic analysis.

Table 3.4

Example 3.1

A building owner has $10,000 available and has the option to invest this money in either (i) a bank that has an annual interest rate of 7 percent or (ii) buying a new boiler for the building. If he decides to invest all the money in the bank, how much will the building owner have after ten years? Compare this amount if simple interest had been paid.

Step by Step Answer:

Energy Audit Of Building Systems An Engineering Approach

ISBN: 9780367820466

3rd Edition

Authors: Moncef Krarti