You are doing the audit of the UTE Corporation for the year ended December 31, 2020. The

Question:

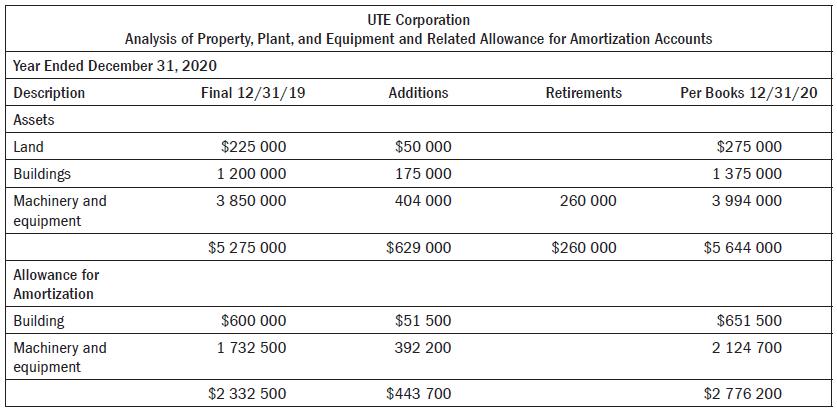

You are doing the audit of the UTE Corporation for the year ended December 31, 2020. The following schedule for the property, plant, and equipment and related allowance for amortization accounts has been prepared by the client. You have compared the opening balances with your prior year’s audit documentation.

The following information is found during your audit:

1. All equipment is amortized on the straight-line basis (no salvage value taken into consideration) based on the following estimated lives: buildings, 25 years; all other items, 10 years. The corporation’s policy is to take one-half year’s amortization on all asset acquisitions and disposals during the year.

2. On April 1, the corporation entered into a 10-year lease contract for a die-casting machine with annual rentals of $50 000, payable in advance every April 1. The lease is cancellable by either party (60 days’ written notice is required), and there is no option to renew the lease or buy the equipment at the end of the lease. The estimated useful life of the machine is 10 years with no salvage value. The corporation recorded the die-casting machine in the machinery and equipment account at $404 000, the present value at the date of the lease, and $20 200, applicable to the machine, has been included in amortization expense for the year.

3. The corporation completed the construction of a wing on the plant building on June 30. The useful life of the building was not extended by this addition. The lowest construction bid received was $175 000, the amount recorded in the buildings account. Company personnel were used to construct the addition at a cost of $160 000 (materials, $75 000; labour, $55 000; and overhead, $30 000).

4. On August 18, $50 000 was paid for paving and fencing a portion of land owned by the corporation and used as a parking lot for employees. The expenditure was charged to the land account.

5. The amount shown in the machinery and equipment asset retirement column represents cash received on September 5, upon disposal of a machine acquired in July 2014 for $480 000. The bookkeeper recorded amortization expense of $35 000 on this machine in 2018.

6. Crux City donated land and a building appraised at $100 000 and $400 000, respectively, to the UTE Corporation for a plant. On September 1, the corporation began operating the plant. Because no costs were involved, the bookkeeper made no entry for the foregoing transaction.

REQUIRED

a. In addition to inquiry of the client, explain how you would have found each of these six items during the audit.

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones