Question: Give a set of test cases for the tax program in Exercise P5.3. Manually compute the expected results. Data from exercise P5.3 Write a

Give a set of test cases for the tax program in Exercise •• P5.3. Manually compute the expected results.

Data from exercise P5.3

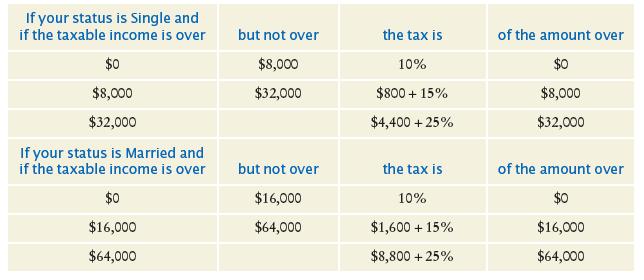

Write a program that computes taxes for the following schedule.

If your status is Single and if the taxable income is over $0 $8,000 $32,000 If your status is Married and if the taxable income is over $0 $16,000 $64,000 but not over $8,000 $32,000 but not over $16,000 $64,000 the tax is 10% $800 + 15% $4,400 + 25% the tax is 10% $1,600 + 15% $8,800 + 25% of the amount over $0 $8,000 $32,000 of the amount over $0 $16,000 $64,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Based on the image provided which outlines the tax schedule we can write a series of test cases for ... View full answer

Get step-by-step solutions from verified subject matter experts