Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not keep

Question:

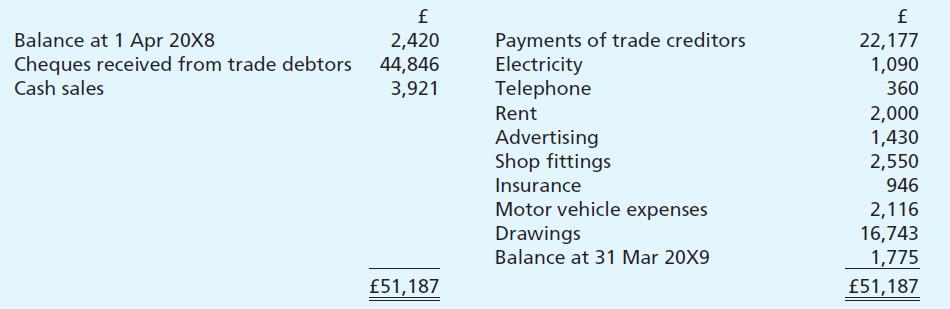

Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not keep complete accounting records, but is able to provide you with the following information about his financial position at 1 April 20X8: Stock of furniture £3,210; Trade debtors £2,643; Trade creditors £1,598; Motor vehicle £5,100; Shop fittings £4,200; Motor vehicle expenses owing £432. He has also provided the following summary of his bank account for the year ended 31 March 20X9:

All cash and cheques received were paid into the bank account immediately. You find that the following must also be taken into account:

- Depreciation is to be written off the motor vehicle at 20% and off the shop fittings at 10%, calculated on the book values at 1 April 20X8 plus additions during the year.

- At 31 March 20X9 motor vehicle expenses owing were £291 and insurance paid in advance was £177.

- Included in the amount paid for shop fittings were:

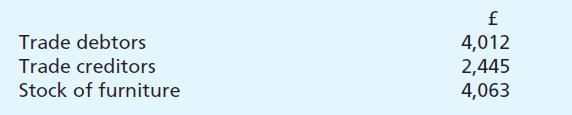

A table bought for £300, which Smithson resold during the year at cost, some wooden shelving (cost £250), which Smithson used in building an extension to his house. Other balances at 31 March 20X9 were:

Required:

(a) For the year ended 31 March 20X9

(i) Calculate Smithson’s sales and purchases,

(ii) Prepare his trading and profit and loss account.

(b) Prepare Smithson’s balance sheet as at 31 March 20X9.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster