General information on the Lytax group of companies: Lytax Ltd is a company in the building construction

Question:

General information on the Lytax group of companies:

Lytax Ltd is a company in the building construction industry.

It has three regional offices, North Borders, Midlands and South Downs, which are constituted as separate units for accounting purposes. On 25 May 2017 Lytax Ltd acquired 90% of the ordinary share capital of Ceprem Ltd, a company which manufactures building materials.

Lytax Ltd has for three years held 15% of the ordinary share capital of Bleco plc. This company carries out specialist research and development activities into building and construction materials, technology and techniques. It then sells the results of these activities to other companies.

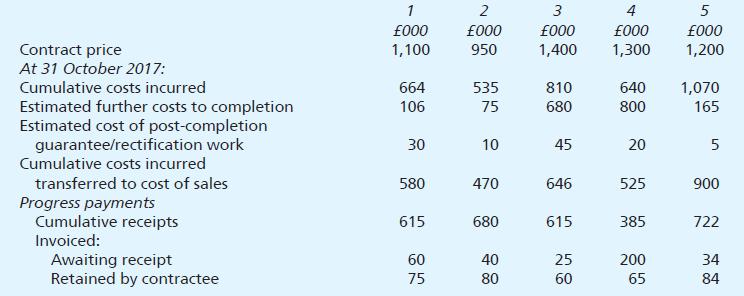

Details of long-term contract work undertaken by Lytax Ltd:

At 31 October 2017, Lytax Ltd was engaged in various contracts including five long-term contracts, details of which are given below:

It is not expected that any contractees will default on their payments.

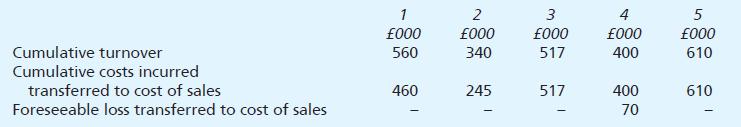

Up to 31 October 2016, the following amounts had been included in the turnover and cost of sales figures:

It is the accounting policy of Lytax Ltd to arrive at contract turnover by adjusting contract cost of sales (including foreseeable losses) by the amount of contract profit or loss to be regarded as recognised, separately for each contract.

Required:

(a) Calculate the amounts to be included within the turnover and cost of sales figures of the statement of profit or loss of Lytax Ltd for the year ending 31 October 2017, in respect of the long-term contracts.

(b) Prepare extracts from the statement of financial position of Lytax Ltd at 31 October 2017 incorporating the financial effects of the long-term contracts.

Your answer should comply with the requirements of IAS 11 (Contract accounts) and IAS 18 (Revenue) and should include any supporting notes required by those standards.

Workings for individual contracts which build up to the total for each item must be shown.

All calculations should be made to the nearest £1,000.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster