Object Limited is a retail outlet selling word processing equipment both for cash and on hire purchase

Question:

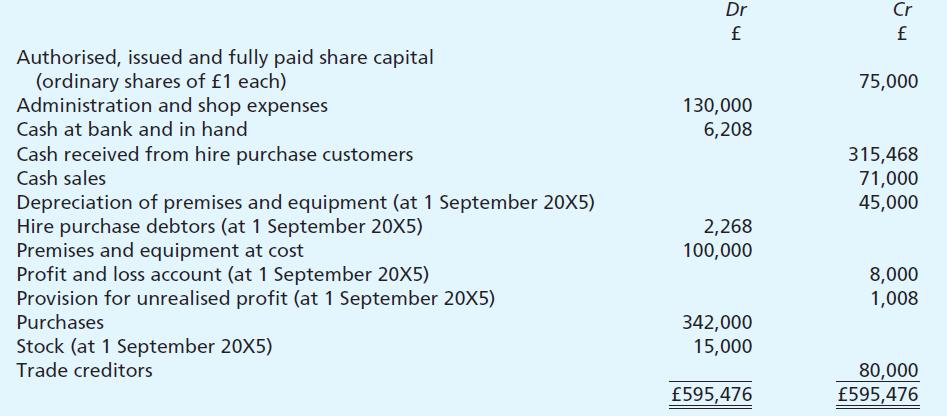

Object Limited is a retail outlet selling word processing equipment both for cash and on hire purchase terms. The following information has been extracted from the books of account as at 31 August 20X6:

Additional information:

1. The company’s policy is to take credit for gross profit (including interest) for hire purchase sales in proportion to the instalments collected. It does this by raising a provision against the profit included in hire purchase debtors not yet due.

2. The cash selling price is fixed at 50 per cent and the hire purchase selling price at 80 per cent respectively above the cost of goods purchased.

3. The hire purchase contract requires an initial deposit of 20 per cent of the hire purchase selling price, the balance to be paid in four equal instalments at quarterly intervals. The first instalment is due three months after the agreement is signed.

4. Hire purchase sales for the year amounted to £540,000 (including interest).

5. In February 20X6 the company repossessed some goods which had been sold earlier in the year. These goods had been purchased for £3,000, and the unpaid instalments on them amounted to £3,240. They were then taken back into stock at a value of £2,500. Later on in the year they were sold on cash terms for £3,500.

6. Depreciation is charged on premises and equipment at a rate of 15 per cent per annum on cost.

Required:

Prepare Object Limited’s trading, and profit and loss account for the year to 31 August 20X6, and a balance sheet as at that date.

Your workings should be submitted.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster