A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to

Question:

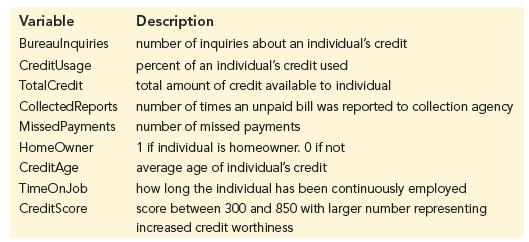

A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to estimate their own credit score (a continuous measure used by banks, insurance companies, and other businesses when granting loans, quoting premiums, and issuing credit). The file creditscore contains data from several thousand individuals. The variables in these data are listed in

Problem 15.

Predict the individuals’ credit scores using a neural network. Set aside 20%

of the data as a test set and use 80% of the data for training and validation.

a. Determine the neural network configuration that minimizes the RMSE in a validation procedure.

b. For the best-performing neural network identified in part (a), what is the RMSE on the test set?

Problem 15

A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to estimate their own credit score (a continuous measure used by banks, insurance companies, and other businesses when granting loans, quoting premiums, and issuing credit). The file creditscore contains data from several thousand individuals. The variables in these data are listed in the following table.

Predict the individuals’ credit scores using an individual regression tree. Use 100%

of the data for training and validation and set aside no data as a test set.

Step by Step Answer:

Business Analytics

ISBN: 9780357902219

5th Edition

Authors: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann