Question: A venture capitalist is considering investing in five different startups that conduct research for developing and improving all-electric and hybrid vehicular technologies. The first two

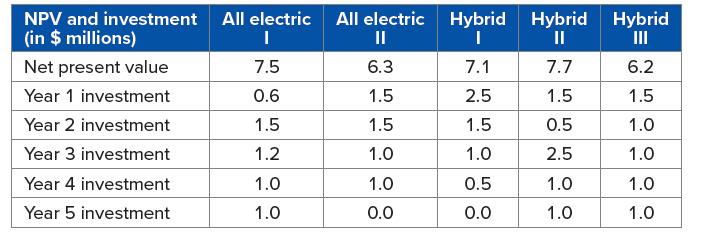

A venture capitalist is considering investing in five different startups that conduct research for developing and improving all-electric and hybrid vehicular technologies. The first two startups focus their efforts almost entirely on technologies related to all-electric vehicles, while the remaining three startups focus primarily on technologies related to hybrid vehicles. The venture capitalist considers each startup’s net present value (NPV) as its potential payout. The accompanying table shows the annual investments and NPV of each startup.

The cash available for investment during the next five years is $6 million, $5 million, $5 million, $4 million, and $3 million, respectively. Investing in startups could be risky, and the venture capitalist wants to investigate different investment scenarios before making any decisions. In the first scenario, only one of the two all-electric startups and only one of the three hybrid startups would receive the funding. In the second scenario, the funding will be given to only three out of the five startups regardless of the types of technologies. In the third scenario, the funding will also be given to only three startups, but the venture capitalist wants to fund the first or second hybrid technology startup, but not both. Use the appropriate optimization technique to analyze the three scenarios and help the venture capitalist decide which startups should receive the funding.

NPV and investment All electric All electric (in $ millions) T || Net present value 7.5 6.3 Year 1 investment 0.6 1.5 Year 2 investment 1.5 1.5 Year 3 investment 1.2 1.0 Year 4 investment 1.0 1.0 Year 5 investment 1.0 0.0 Hybrid Hybrid Hybrid I II 7.1 7.7 2.5 1.5 1.5 0.5 1.0 2.5 0.5 1.0 0.0 1.0 6.2 1.5 1.0 1.0 1.0 1.0

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

To analyze the three investment scenarios and determine which startups should receive the funding we can use a linear programming approach Linear prog... View full answer

Get step-by-step solutions from verified subject matter experts