Question: For the Markowitz model in Example 14.10, determine how the minimum variance and stock allocations change as the target return varies between 8% and 12%

For the Markowitz model in Example 14.10, determine how the minimum variance and stock allocations change as the target return varies between 8% and 12% (in increments of 1%) by re-solving the model. Summarize your results in a table, and create a chart showing the relationship between the target return and the optimal portfolio variance. Explain what the results mean for an investor.

Data from Example 14.10

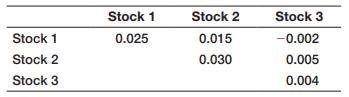

Suppose an investor is considering three stocks in which to invest. The expected return for stock 1 is 10%, for stock 2, 12%, and for stock 3, 7%, and she would like an expected return of at least 10%. Clearly one option is to invest everything in stock 1; however, this may not be a good idea because the risk might be too high. Research has found the variancecovariance matrix of the individual stocks to be the following:

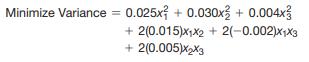

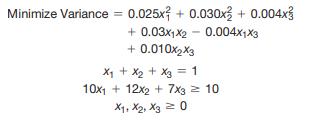

Using these data and formula (14.2), the objective function is

The constraints must first ensure that we invest 100% of our budget. Because the variables are defined as fractions, we must have

x1 + x2 + x3 = 1

Second, the portfolio must have an expected return of at least 10%. The return on a portfolio is simply the weighted sum of the returns of the stocks in the portfolio. This results in the constraint

10x1 + 12x2 + 7x3 ≥ 10

Finally, we will assume that we cannot invest negative amounts: x1, x2, x3 ≥ 0 The complete model is

Stock 1 Stock 2 Stock 3 Stock 1 0.025 Stock 2 0.015 0.030 Stock 3 -0.002 0.005 0.004

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Data Expected VarianceCovariance Matrix Return Stock 1 Stock ... View full answer

Get step-by-step solutions from verified subject matter experts