![]()

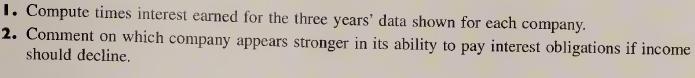

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()